Fashion is constantly changing, adapting to new trends set and evolving to meet new expectations. Fashion eCommerce is no different in that regard and within the last 12 months, it has seen more change than ever before.

The increase in demand for online fashion caused by the Coronavirus pandemic has forced industry leaders to change the way they sell to the masses. So how has fashion eCommerce adapted to the fluctuating market? What new trends have developed within the industry? And what areas have seen the most change?

Contents:

Ecommerce growth around the world

Fashion eCommerce growth by vertical

Multichannel and omnichannel strategies

Market trends in the fashion industry

Delayed payment options become more prevalent

The introduction of digital fitting rooms aids online conversions

The influence of COVID-19 on fashion eCommerce

Ecommerce issues and resolutions

Fashion eCommerce 2021 growth

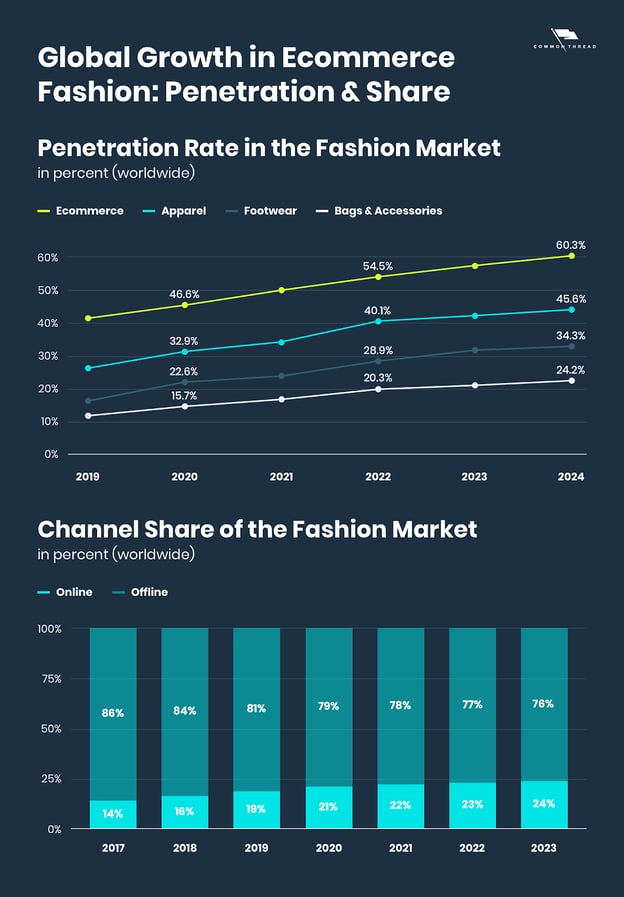

According to Statista, the online fashion industry was worth over $439 billion in 2018. This staggering figure is projected to grow to more than double that amount ($953 billion) by 2024, and is currently expected to reach over $758 billion in 2021.

This substantial growth is led by sectors such as apparel, accessories, and footwear, which by 2024 are expected to together account for 32.8% of all fashion eCommerce sales.

As the years progress from 2021 to 2024, we are also expecting to see a significant increase in the penetration rate and channel share of the fashion market, with an increase to all three of the main sectors, as well as fashion eCommerce in general.

By the end of 2021, online channel share is expected to amount to 22% of the fashion market sales worldwide, whilst the eCommerce penetration rate in the fashion industry is expected to hit 50%.

And with growth in the industry expected to continue for the foreseeable future, there is no end to the opportunity in the online fashion industry.

Ecommerce growth around the world

Ecommerce sales in the fashion industry are growing worldwide, with that trend expected to continue for the foreseeable future. However, certain countries are seeing exponential growth, far exceeding the growth of others.

The country currently seeing the most growth is China. China is the home of various renowned eCommerce marketplaces that dip into the fashion industry, such as AliBaba and TaoBao.

Over $284 billion sales were made in China in 2020, with the next highest being the United States at just over $126 billion.

Despite China’s much larger growth in the sector than other nations, the growth of countries such as the United States and the United Kingdom shouldn’t be taken lightly. Many western nations and their brands are still playing a significant role in driving up sales globally, and like in the case of China, that trend is also expected to continue.

It should be noted that many consumers in western nations, like the United States, tend to spend more per user, which may even highlight that the exponential growth in China is partially down to the simple factor of having a much larger population to target.

The disparity between the United States and China in terms of average revenue per user is also expected to increase in the coming years and will be especially evident in the apparel sector. In 2019, the average US user spent $432 a year on apparel, compared to just $296 in China.

Whilst China’s ARPU is also expected to increase by 2024 (to $310 per user), it pales in comparison to the expected increase of an average user in the United States, who is expected to spend a whopping $532 by 2024.

Fashion eCommerce growth by vertical

This year of all years, it is important to measure growth by vertical. That is because the Coronavirus pandemic has created trends within eCommerce that steer us away from typical growth patterns, and change everything we have seen before in terms of the most popular verticals.

The fashion industry is the perfect example of this. The industry had seen solid year-on-year growth for some time, in every sector. However, for the duration of 2020, each sector suffered a decline in sales. This can be seen via these example from the US market:

- Accessories: - 12.69%

- Apparel: - 2.88%

- Luxury: - 11.11%

- Eyewear: - 4.9%

- Footwear: - 5.54%

This decline can be attributed to the effects of the Coronavirus pandemic, which left many people out of work and with less disposable income for items that are not considered necessities.

And whilst many states shutting down led to increased sales online, fashion still suffered due to a vertical that isn’t considered essential by many buyers. This is most notable in the luxury sector, and accessories sector, which show the two largest drops.

It is no coincidence that these sectors are also the least essential of all the fashion industries eCommerce areas.

Despite the negatives from 2020, year-on-year growth has been steadily increasing, so it is likely the fashion industry will eventually regain the lost sales and eventually continue to grow again.

Many even predict that growth to begin as early as the late stages of 2021, creating a positive outlook for fashion retailers in the near future.

A truly personal experience

Personalization is something that ties perfectly into fashion. Fashion is a medium through which people can express themselves, and even show what they stand for and their beliefs. So what better way to attract buyers to your fashion brand, than to allow customers to personalize their purchases and experiences so they can show who they are.

The personalization of goods has been going on for a while now. Many brands offer ways to make a customer’s clothing stand out from the crowd. The big change is how brands are now making the shopping experience unique and personalized - so their customers can really get the most out of their personalized fashion.

The most common elements of experience personalization are:

- Personalized emails (with the customer’s name included)

- Product recommendations based on purchasing history

- Product advertisement based on browsing history

However, experience personalization has now been taken to a whole new level by many brands who seek to unify with their loyal customers all the more. They are doing this by learning more about their customers through their behaviors, preferences, and history, and tailoring the whole buying experience, such as which products are seen on the homepage to specific customers.

This new level of personalization includes features such as:

- Personalized sized guide - This is deciphered through a customer’s past purchases and matched up with the measurements the customer provides. It also uses other purchases and returns of other customers who have the same measurements to see how likely you are to be a certain size for a certain brand. Other information, such as how tight you want the item of clothing to fit your body can also be used.

- Style quizzes - These quizzes or questionnaires allow brands to get an in-depth understanding of what their customer’s taste is clothing is like, so they can recommend better products, and even matching items in the future. Style quizzes often encompass questions for the size guide too, as well as related questions for the budgets of customers.

- Interface flexibility - This lets customers arrange what they want to see on their homepage, so they can stay up to date on what they want to, and find things with ease. It may also include features like dark mode, which make the website easier on the eye.

- Personal stylist - Some brands have taken things to a whole new level, by adding the option to pay a small fee for the expertise of a personal stylist. The fee is also often credited towards any purchase you later make on the site, so if you make a purchase you essentially get style tips for free. This feature provides customers with a feeling of being truly valued by the store.

- Artificial intelligence - Many brands have also turned to artificial intelligence and algorithms to provide customers with a personal experience when purchasing. Artificial intelligence is used in many of the aforementioned areas, such as styling and sizing. It is also often used to recommend products and even change the copy seen by customers on a page.

Back to The Top or

Multichannel and omnichannel strategies

Multichannel and omnichannel strategies are becoming increasingly prevalent ways to draw customers into online fashion. The immersion of customers across channels helps your brand to be recognized and test which platforms are best and most effective for your business to be remembered. So what exactly are these strategies, and how do they work for businesses hoping to make inroads in fashion eCommerce?

Multichannel strategies

A multichannel strategy is when you aim to establish a consistent approach to reaching your target demographic in spaces they already frequent. This could be on your own online store, on marketplaces, other shopping channels through advertising, or even through your social media accounts or other digital communities (eg forums).

For a multichannel strategy to be at its most effective, the message shown across all platforms needs to be cohesive and consistent. This means a great deal of research needs to be done to ensure that you show your customers what they want, even if they do not shop in the same way or in the same place.

In a multichannel strategy, you may have to adjust the campaign to the platform. However, you must try to ensure the overall message stays the same and truly represents your brand.

A great way to manage to achieve this is to select a landing page you want all your campaigns, across all your channels to lead to. This will help to immediately give you an idea of what you need to include in each promotion to ensure relevancy and consistency.

And as long as the message remains the same across platforms, you can use any method appropriate to reach your customer base on a channel, and guide customers to your landing page. Here are just some of the possible methods you can use to reach your target audience on a channel:

- A text ad

- A sponsored post

- A series of social media posts/ads

- An on-site quiz/questionnaire

- A series of emails/newsletters

- Physical leaflets with QR codes

It is also important to define the goal before any multichannel marketing campaign. You may wish to retarget customers who have previously shown interest in your products, reach out to a completely new audience, or simply test which platforms are best and most effective for your business.

But regardless of the goal of your campaign, you should always ensure you have a relevant landing page that suits every element of your multichannel strategy.

Omnichannel strategies

An omnichannel strategy is when a brand uses marketing methods of any kind to send its message to its customers. The message does not change depending on the customer, or on the channel they use, as all channels are connected by a singular brand message.

Omnichannel strategies can be highly effective with the right message, especially if a brand covers numerous online and offline channels. The strategy makes the brand’s approach to consumers seamless, with no conflicting visions or messages.

It also ensures that customers are frequently reminded of the items they were considering, regardless of where they are currently searching.

One of the most obvious and effective methods of an omnichannel strategy is click and collect.

Click and collect allows customers to order products online, and then collect that product in a physical store. This then exposes them to both online branding, as well as all the products in the shop at the time of collection. Click and collect is also useful as it allows customers to skip the physical queue when in a store.

Another popular form of bridging the gap between online and offline is the QR code, which allows customers to scan it for more content. That could be information on a product, a video of it being modeled, or even when stock is expected to be updated. All these things add a positive aspect to the customer's experience.

Successful omnichannel strategies, a clear sign, and eCommerce and the brick & mortar business can co-exist. They can even supplement one another, easing the transition from offline to online, and vice-versa.

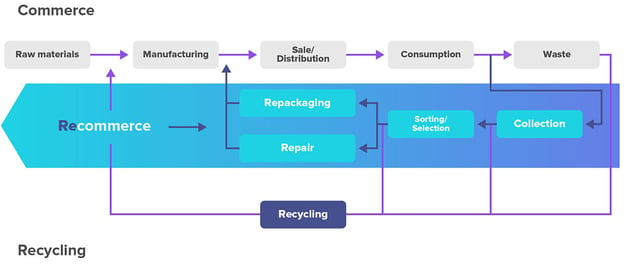

Reverse commerce

What is reverse commerce?

Reverse commerce, also known as recommerce is essentially the re-sale of pre-owned apparel.

This can be through an online or offline store. Reverse commerce is currently seeing a boom in popularity, partially due to the economic strain on a large segment of the population.

However, the boom is also fuelled by customers’ desire to be ethically and environmentally better.

How is reverse commerce driving sustainable sales and growth?

Due to its sudden growth in popularity, reverse commerce is fuelling the sustainability of the fashion industry. Many buyers have less income, but there is also a desire to be more environmentally friendly.

This also causes brands to take accountability for their emissions, producing their own lines of recycled and environmentally friendly clothing, such as ASOS’s entirely bamboo made products.

However, recycled clothing isn’t the only thing catching people’s eye. Second-hand fashion is also seeing a massive increase in popularity, with an increase of 69% in physical stores in the US (prior to the pandemic: 2019-2021).

But this developing trend is not just for smaller stores - bigger fashion houses have also taken note, with some even opening dedicated second-hand stores under their brand name. And with the environment being an ever-growing issue, this trend seems set to continue its growth and stem out further.

Market trends in the fashion industry

The fashion industry is fast-paced. Trends come and go, adapting to new environmental factors and changing to suit new desires. Fashion eCommerce is no different from the rest of the industry in that regard. Here are some of the most significant trends and changes to the market within the last year.

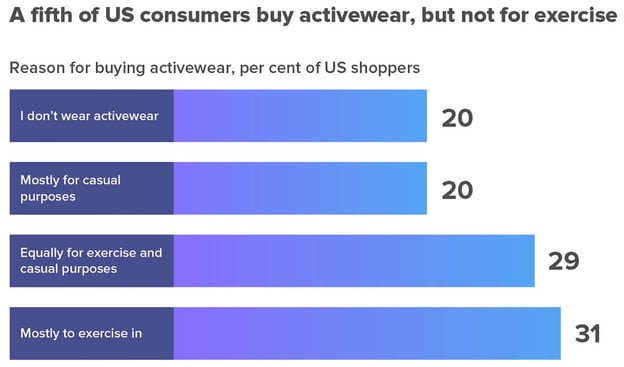

Activewear turns loungewear

In a time where many gyms, fitness centers, and other places of exercise around the world are shut off to the public, activewear continues to thrive.

This is somewhat down to a developing trend, where activewear is used as casual fashion and worn in day-to-day life, or simply around the house.

In fact, 20% of shoppers in the US state that they wear activewear as casual clothing, with a further 20% using it for both exercise and casual activity.

Helped along by the desire for practicality and comfort, activewear is thriving outside the US market too - particularly in Europe and Asia. And the trend seems set to continue, with numerous celebrities now endorsing activewear lines, or even releasing their own.

Exposure to activewear is also growing. Instagram’s vicarious nature allows clothing to be showcased in a less pushy manner, meaning influencers practicing yoga, fitness and other similar topics can also promote activewear products on a daily basis.

And what better time to promote this form of clothing. With many people stuck at home due to the ongoing pandemic, comfort and practicality are what many people are looking for in clothing.

Items that allow people to lounge around or exercise are the best of both worlds, so demand will naturally rise. All of these factors are contributing to a trend set to go to the distance, as people come around to the idea that comfort can still look good, and it is certainly the best way to go in the current environment.

Seasonless fashion

Seasonless fashion is another trend that has taken flight due to the ongoing pandemic. Many world-renowned fashion houses have abandoned their seasonal lines due to the fact most people are not spending enough time outside for them to be warranted.

However, it has been noted that this trend was developing prior to the pandemic anyway. With people now more economically and environmentally conscious, throwaway seasonal fashion has no place in the world.

This is further compounded by the fact that using clothing for an extra 9 months can reduce a person's carbon footprint by up to 30%. For that reason alone, many customers prefer to extend the use of their clothing items.

Designers are also creating products that transcend the seasons, and are less extreme in color, weight, and design. By doing so, fashion houses can offer the same products in multiple seasons and not force multiple collections during a year where people have less disposable income anyway.

Another reason for the lack of seasonal fashion is the nature of eCommerce itself, which has created a much faster purchasing process. Many consumers purchase an item the same day they see it. It is rare that an online customer will wait til the perfect season to make a purchase, especially with product availability being constantly online.

This mentality is further reinforced by another environmental factor, the weather.

Unpredictable weather takes away the need for seasonal fashion, especially in countries that can see several kinds of weather on the same day. Customers instead seek out practical items that are ideal for any kind of weather.

Genderless fashion

Another trend that is representative of the ever-adapting world is genderless fashion. The increasing popularity of genderless fashion is a sign of modern times, where more people are happy and comfortable enough within society to disclose how they identify.

This is shown more recently through the introduction of the clothing label non-binary, a change that has since been officially recognized in the United States.

As society continues to make progress in this area, it is widely expected that the demands for non-binary clothing will only increase around the world. For that reason, many designers have already started their own process of adaptation, with some creating non-binary lines of clothing, and others even removing gender labels from all their ranges entirely.

However, the trend of genderless fashion is not only being pushed by a developing society, but by practicality. The clothing label ‘unisex’ has been around for some time now. But it is also seeing an increase in popularity (partially due to the aforementioned changes) because clothing previously recognized as being for one gender is now recognized as being just as practical for the other.

Forward-thinking brands such as Printify and Printful have identified the move toward gender-neutral products as a powerful way to expand their market reach. By dropping gendered labels, they open their collections to a wider audience, with items like custom hoodies, T-shirts, and even jewelry now commonly positioned as unisex essentials.

Delayed payment options become more prevalent

For many consumers paying large sums on clothing, shoes, and accessories is out of reach and unsustainable. Especially when that large sum is demanded all at once. However, brands do not want to exclude potentially loyal customers who may have a larger amount of spare income in the future. That is why many chose to introduce delayed payment options.

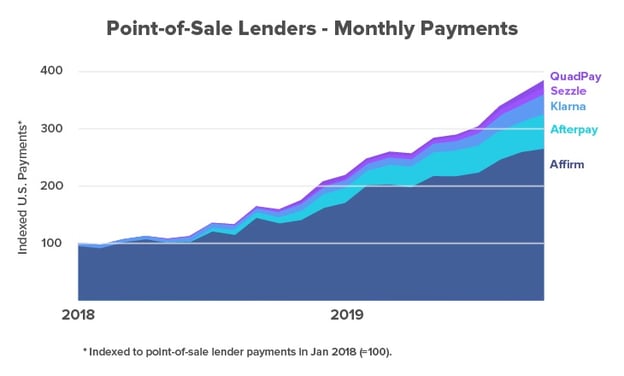

Delayed payment options allow customers to purchase an item, and pay for it over time like they would on a mobile phone contract. These payment plans are usually offered through services such as Klarna, Afterpay, and Openpay, services which now unsurprisingly are also seeing growth.

By allowing customers to pay in installments, brands open themselves up to a wider range of customers from more pressing economic backgrounds - essentially telling these customers that they are valued too.

Installment payments have helped to build relationships with customers who were previously neglected. Many customers are now spending more per shop, with average order value increasing, as well as conversion rates. And installment payments are spreading across fashion eCommerce. Previously, they were something only touched by mid-range department stores and marketplaces such as ASOS.

However, we are now seeing designer brands such as Givenchy join in with the idea that no type of consumer is out of their reach when the initial high cost isn’t there to put them off.

Staggered payments are set to continue their growth in popularity over the next year, with many seeing them as a way of opening doors to new audiences and the brands they covet.

The stable and safer alternative to debt-ridden credit cards is expected to continue to break fashion eCommerce barriers to make the market accessible to all in 2021, and beyond.

The introduction of digital fitting rooms aids online conversions

For many years, one of the biggest drawbacks stated by those shopping online was that they couldn’t truly see themselves wearing/using the product. Therefore, they didn’t know if it would even suit them, never mind if it would actually fit them in terms of both size and body shape.

Brands have constantly sought out ways to manage this issue, and encourage more people to shop online. Size guides and clothing quizzes are just some of the ideas that have been regularly utilized. Yet, so far, there has been no one solution that everyone has accepted as foolproof.

The latest attempt to aid with online fashion shopping conversions is the digital fitting room. These fitting rooms use virtual reality technology to allow customers to see themselves in the clothing, and judge how they would look.

The aim is to create an experience that is most similar to that of going to a physical store. This use of virtual reality technology follows on from try-on experiences of the past, where you entered your physical details and a website would provide a model of similar stature wearing the item.

However, by using VR, the aim is to take things to the next level by allowing you to enter those same details, but using your own image instead.

An alternative to virtual reality technology is augmented reality technology. Augmented realityallows customers to point their phone camera at any flat surface, and view models as if they are in the same room. This helps customers get a better idea of sizes, and the fits of products.

A significant part of buying fashion products is the experience, much of which can be lost online. People buy clothes for many reasons, but one of the main reasons is they want to truly feel good about themselves. So by providing an opportunity for a customer to see themselves in an item of clothing, or a model directly in front of them, digital fitting rooms meet another need of shoppers.

The ingenuity and development of technology are continuing to improve online shopping experiences for customers day by day. And with each new development, customers get that little bit closer to the true shopping experience.

Something that is all the more important now that people are relying on online shopping due to pandemic restrictions preventing physical stores from opening.

The influence of COVID-19 on fashion eCommerce

We have already mentioned the influence of COVID-19 on fashion eCommerce in this piece. In truth, it is hard not to. The Coronavirus pandemic has forced the industry into a rapid transformation in some regards, with many businesses having to adapt to survive.

The positive for fashion eCommerce is that it has been less affected than many other industries, and it is still expected to rebound. But despite that, the current climate still means continued adaptation is necessary. Here are just some of the many ways the ongoing pandemic has influenced the eCommerce fashion industry.

A poor calendar year

The pandemic has led fashion eCommerce to its worst year in a long time. Many people lost their source of income or at least had it depleted. This meant they had less expendable income, meaning fashion and clothing - which are much less essential in a pandemic were suddenly tossed aside.

But despite the poor 2020, many fashion retailers expect 2021 to be a little brighter. Projections estimate that 2021 will restore normality in the world of fashion eCommerce, with profits returning to their previous pattern.

But that being said, the pandemic has been unpredictable so far. Businesses should still consider alternatives, just in case better times aren’t as close as they seem.

Luxury goods badly hit

Luxury goods were one of the main areas of fashion eCommerce hit by the COVID-19 pandemic. Growth in the luxury sector dropped over 11%, which highlights the significant drop in many people’s disposable income.

The drop in sales of luxury goods has led many brands to re-thinking their current catalogs of fashion products. Many are choosing to focus more on products that people need or can be used in a home environment (such as the aforementioned activewear).

And with most nations having no end to their lockdowns in sight, this new product focus is likely set to continue for the majority of 2021.

Community centric initiatives to encourage purchases

With purchases down for most fashion brands in 2020, many have taken it upon themselves to create fresh initiatives with the hope of drawing in customers in the long run. The best of these initiatives are not those that drive short-term profit, but instead are initiatives that help the community.

Campaigns, where brands donated profits to local businesses or donated PPE (personal protective equipment), were some of the most effective, as they helped a downtrodden community see the brands in a positive light.

Brands started these campaigns with the hope of helping, and of attaining positive PR. Both of which seem to have fallen into place perfectly.

Fulfillment issues and delivery chaos

The pandemic has been rife with fulfillment issues and delivery chaos from the start. Initially, many companies were simply not ready for the scale of demand for products, but with more and more people having to order things online, demand only continued to increase.

This issue recurred again at Christmas, with stocks falling short, and delivery companies being unable to fulfill all orders within the parameters required. International shipping was a particular issue, with numerous travel embargoes preventing items from being shipped on time, or at all.

All of these fulfillment issues had an impact on fashion eCommerce, with many companies having to turn down business because they couldn’t meet a reasonable delivery time.

In 2021, it is expected that this exceptional demand on fulfillment centers will gradually decrease over time. Many countries in Europe, as well as the US, expect to gradually reopen, at least towards the end of the calendar year.

This will help to alleviate some of the intense stress placed on delivery systems worldwide and allow for in-store shopping, as well as click and collect. But despite that, many customers may not go back to old habits. Ordering online remains convenient, and many will have been converted to the idea of buying from shopping channels during 2020.

The transition to stay at home fashion

Activewear as loungewear has become the staple of ‘stay at home fashion’ during the pandemic. This is because of the amount of time many people are spending inside.

The transition to ‘stay at home fashion’ has developed throughout the pandemic, with comfortable clothing seeing a boost in popularity due to the circumstances.

Many buyers are opting for clothing that allows them to get the most of several different activities during a day, rather than being optimal for aesthetics - which is now less important than ever.

The lack of importance in aesthetics is also contributing to the decline in purchase frequency during the last year. However, with nations expected to slowly open back up in the next 12 months, we may yet see people making up for the lack of purchases in 2020.

Ecommerce issues and resolutions

Over the course of the last year, eCommerce has had to face a number of unprecedented issues. Fashion eCommerce is no exception to that. Many of these issues are set to continue into 2021, due to the ongoing pandemic.

However, so far the industry has adapted well to everything thrown at it. Here are just a few of the main issues that are still pressing eCommerce to this date, and their potential resolutions:

The ongoing battle with demand

Demand and supply are something many companies have been struggling to deal with in the last year. And with Coronavirus restrictions frequently changing around the world, this trend is set to continue for the foreseeable future.

So how can companies get their supply right?

Resolution:

Brands should use data to try and recognize any changes in sales patterns. Coronavirus has been around for over a year now, so it may be a little easier to spot patterns that match both the virus and the time of year.

However, you should also try to keep an eye on any changes in restrictions in areas you make a lot of sales. Tightened restrictions may lead to a sudden flash of demand for online stores.

Adapting to markets in different (or fluctuating) states

As more and more people are slowly vaccinated around the world, we will start to see different geographical markets in different positions. Some nations are expected to be completely out of lockdown by Autumn/Fall at the latest.

Whilst others still haven’t had a single vaccine and are not expected to leave lockdown until the following year at the earliest. So how do you ensure you have the right strategy for each market?

Resolution:

There is no easy way to do this. In fact, extensive research, while staying up to date may be the only way to manage it, taking the issue nation by nation. You can almost be certain that you will have two countries with vastly different outlooks financially, as well as in terms of restrictions.

Therefore, you need to take your time to judge the supplies you will need, and how best to market to each country. You should also ensure you regularly check for any changes to a market, as missing an update could have a significant impact on your business.

Taking eCommerce to the next level

Ecommerce is making rapid progress towards being just as effective as in-store purchasing. However, there are still elements missing from online purchasing, such as the other sensory experiences. At the moment, there is very little to tell people how a material sounds, feels, and even smells. These factors can be just as important to many buyers, and can even be essential in some cases.

Resolution:

Descriptions of how materials sound and feel to a person could go a long way to bridging that gap until technology can cover it itself. Audio descriptions, as well as clips of how material sounds when touched, could also help those who are visually impaired or have autism, which would open up eCommerce to an even wider audience.

Final thoughts

The last year was a challenging one for the fashion industry. The ongoing pandemic created unprecedented challenges for the industry that it battled through. And although many of those challenges are set to continue, there is now a light at the end of the tunnel for many businesses.

Technology and increased personalization are just two of the factors pushing fashion eCommerce forward. And if the industry continues along that road, it is expected to see its successes at least somewhat restored as 2021 progresses.