Staying well-informed about the current eCommerce landscape undoubtedly helps enhance your advertising strategy. Understanding the strategies employed by fellow retailers in your industry not only helps you gauge your own position but also highlights opportunities for refining your advertising approach.

That’s where the Multichannel Marketing Report 2023 comes in. We proudly partnered with our sister company, SellerActive (Marketplace Management), to create an all-encompassing analysis of the current state of eCommerce.

Let’s dive in!

What’s inside the study?

Drawing on data from over 16,000 stores across 300 eCommerce channels and 60+ countries, we've turned thousands of product feeds into actionable insights.

- Discover 2023 trends and emerging opportunities in the digital distribution space

- Find out the best channels to advertise on for your product category and market

- See what strategies eCommerce brands are deploying for success: pricing, inventory, and more

- Get the winning PPC tactics to drive your performance in 2024

eCommerce 2023/2024 in numbers

The last few years have seen dramatic eCommerce changes, stemming, of course, from the 2020 pandemic. In 2023, the impact of this has finally become less apparent, although there are still some product shortages in a couple of product categories, like Vehicles & Parts and Electronics.

Becoming more strategic with multichannel selling

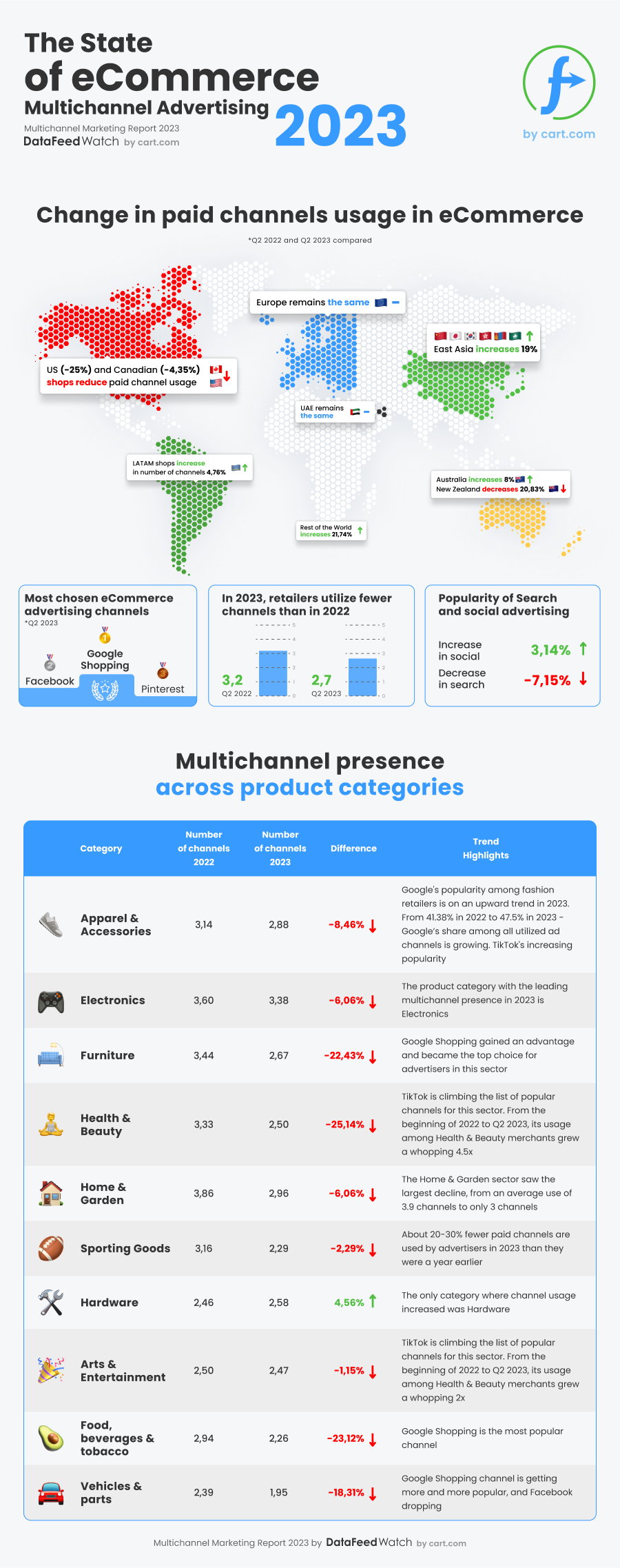

What we have seen instead are changes made due to economic uncertainty across the globe. Over the last year, retailers across all product categories have started to sell on fewer channels, from 3.2 to 2.7 channels on average. This points to a trend of becoming more strategic with multichannel selling strategies.

Rather than spreading ad budgets thin across various channels, retailers have decided to drop channels in favor of concentrating their efforts on those more profitable. Wondering if you should do the same? We’ve seen a correlation between inventory size and the number of channels retailers sell on.

For example, shops selling over 200k products advertise on 13.8 channels on average, while on the opposite end, those selling 1-5k products advertise on 3 channels on average.

It also varies by product category. Looking at both ends of the spectrum, retailers selling Electronics list on about 3.4 channels on average, Vehicles & Parts advertise on almost 2.

It’s also interesting to note the changes that took place with each category. Hardware was the only one where advertisers have expanded to new channels, and Sporting Goods saw the biggest shift downwards.

eCommerce Advertisers shift from Search to Social

Another interesting trend that arose was the shift in the kinds of channels retailers are turning towards. A 7 percentage point decrease in the popularity of Search channels has coincided with a 3 percentage point increase in Social channels.

Accenture has predicted that social media channels will grow in popularity 3x faster than other more traditional forms of eCommerce advertising. We’ve seen drastic growth like this reflected in TikTok. In 2023, TikTok usage in the Apparel sector more than doubled, and grew almost 5x in the Health and Beauty sector.

If you’re advertising in either of these two sectors and haven’t explored TikTok as a channel yet, now might be the time to swoop in.

Increase performance through product feed optimization

To come out on top in a competitive eCommerce landscape, you need to be among the best of the best. One of the most important things you can do to ensure this is enhancing your product feeds. Curious about where to start?

Custom labels

One of the most common tactics among merchants is segmenting your inventory into categories through custom labels. Close to 50% of advertisers deploy this tactic to optimize their bidding. When choosing the criteria to create their labels, 17.91% use their products’ sale status.

Excluding unprofitable products

Another powerful tactic deployed widely among merchants is excluding products with low potential from your feed to get the most out of your ad budget. By far, the leading criteria for removing products from campaigns are specific keywords found in product titles, price, and availability.

Leveraging additional images

Compared to 2022, 15% more merchants equip their ads with additional images, with the goal of easing the anxiety of first-time purchasers. Now, almost ⅓ of online advertisers add about 2.2 extra images on average. This means they’re realizing the need to give shoppers the best possible idea of what the product is before they buy. Adding lifestyle images, rather than just stock photos, also helps shoppers visualize the product and make a more informed decision.

There’s more data to uncover…

There are over 90 pages of data analysis and insights just like this to be discovered. Just a couple of clicks stand between you and the report. Happy reading!