Something significant and historical is happening in Europe right now, and it isn’t the return of the Teletubbies! For the UK, the future of the retail sector has been thrown into chaotic uncertainty yet again.

We look at the good and the bad that Brexit presents and how e-retailers can brace themselves for the inevitability these changes might bring.

Brexit could not have come at a worse time for high street as many retailers are already surviving on paper-thin profits in the face of slumping sales.

Around 84% of high street shops are running promotions to shift stock, according to retail analyst Richard Hyman.

As expected, the British pound plunged after the referendum results were in. The pound actually sank to its lowest level since 1985.

Despite months of endless speculating, some businesses are still in disbelief that Britain has decided to leave the EU and are wondering what to do next.

So how does this affect retailers?

Firstly, let’s look at the positives, because every cloud has a silver lining:

- For UK retailers selling outside the country, the devaluation of the British pound will make products and services purchased from British companies cheaper if they pay in another currency.

- Brexit could offer a massive opportunity for Made in Britain to thrive. British retailers that source locally will benefit from the sterling’s weakness. Manufacturing in the UK has dwindled but buying British could be a fashionable way out. There is likely to be a resurgence in overseas acquirers as the weaker pound makes British companies attractively affordable.

- UK consumer spend at foreign e-commerce websites will decline initially. But this could bode well for local UK stores as people may be encouraged to shop locally instead.

The possible negatives:

- Import tariffs are likely to be implemented for goods imported from the EU. At the moment the UK pays zero on goods imported from other EU countries. Whereas an average of 5.3% import tariffs are paid on goods imported from the rest of world and 12.2% on agriculture. Currently 60.7% of manufactured goods come into the UK with no tariff, as do 46.1% of foodstuffs (source: WTO figures 2014).

- We assume the UK will retain VAT as an accepted tax on sales. The UK standard VAT rate is now amongst the lowest in Europe, but leaving the EU may not mean that it stays the lowest as VAT is a very easy tax to increase. Some speculate that as consumer spending decreases VAT will rise.

- UK Retailers sourcing their products from the EU will invariably pay more to import their goods. This will result in lower margins if their goods are sold in their UK online store.

How can retailers can take positive action:

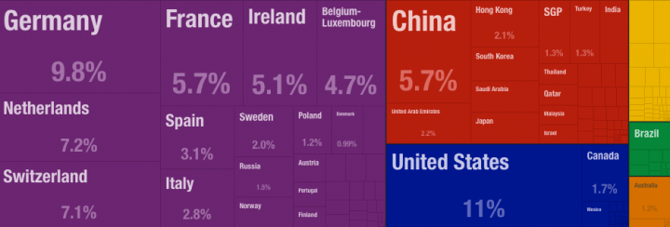

- Online retailers should broaden their international reach by registering on more international shopping channels since the weaker sterling will mean an increase in foreign purchases. If you’re not selling in the US, it’s time to implement it! (The US is the second-largest market taking 11% of the UK’s exports, totaling: $51B)(source: OEC). You don’t need to have a store in the UK to register on Amazon Germany, for example, and you can easily create data feeds for international channels.

(UK Export chart: 2014)

- All online campaigns should be further optimized. That means improving product titles, adding custom labels, removing under-performing products and keeping a closer eye on campaign analytics.

- Cut back on hiring more staff by finding tech solutions that can automate some systems in your operation.

- Retailers who sell online should immediately cut back on waste. Managing product feeds for various shopping channels must be handled effectively with a fast and cost effective tool. No smart retailer today does product feed management manually.

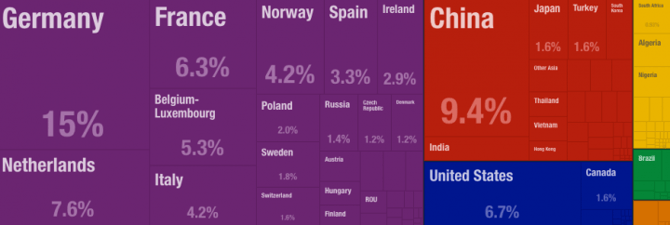

- Source locally since Made in Britain is likely to thrive. Currently the UK imports 9.4% of goods from China, 15% from Germany and 7.6% from Netherlands (source: OEC)

(Import chart): In 2014 the UK imported $663B, making it the

5th largest importer in the world!

- Keep a close eye on what your competitors are charging so you can stay competitive.

- Make sure your VAT costs are transparent so shoppers know what they are paying upfront. This will prevent consumers from abandoning shopping carts before payment.

- Optimize, optimize, optimize. This is really the very best thing that you can do. Make sure your campaign managers are accountable and can show you how and where they have improved your ROI and ROAS.

With these recommended actions you can vastly reduce any negative impact Brexit may have on your retail operations.

Author: Amour Setter