E-commerce has rapidly grown in recent years, leading to an increase in competition for businesses to capture customers' attention. Understanding the latest eCommerce statistics and digital advertising trends is crucial for businesses looking to stay ahead in the game.

This piece highlights key eCommerce and advertising stats from the 2022 Feed Marketing Report by DataFeedWatch by Cart.com, with a focus on the factors that businesses should consider in order to effectively reach and engage with their target audience. From Social Media and Google Ads stats to more general eCommerce trends and local, we provide insight into the ever-evolving world of online advertising and how businesses can stay competitive and drive sales growth.

Social Media Advertising Stats

Social media advertising has become an essential aspect of modern marketing strategies. With billions of active users, platforms such as Facebook or Pinterest offer unparalleled opportunities to reach a large and diverse audience. In this chapter, we will dive into the latest statistics on social media advertising, exploring key trends and insights on the industry's growth and impact on businesses.

All statistics are from Feed Marketing Report 2022 (except the first one, which is from Statista).

1. Global social commerce sales will grow to $2.9 trillion by 2026

The global sales of social commerce in 2022 across all platforms were estimated to be worth $992 billion, and this indicates a significant increase in the use of social media for eCommerce purposes. According to Statista, the value of sales through social commerce channels is projected to reach $2.9 trillion by 2026.

The rise of social commerce is expected to continue as consumers become more familiar with the practice and retailers invest more in social commerce strategies. This trend will likely lead to a shift in the way businesses engage with their customers and sell their products, as they look to tap into the growing audience on social media platforms. Platforms such as Facebook, Pinterest, and Instagram are becoming crucial channels for online commerce.

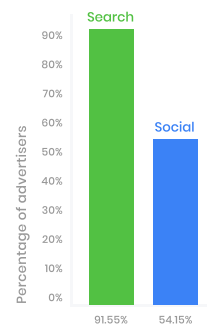

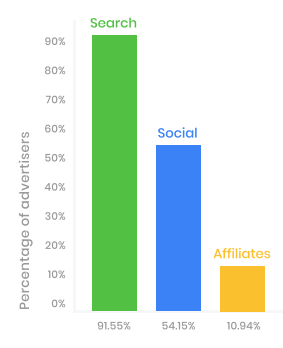

2. Over 54% of sellers use Social channels to promote products

It is not surprising that almost 92% of advertisers choose to include Search in their online marketing strategy, as it allows them to connect with consumers who are actively looking to make a purchase. But it turns out that paid Social remains an important source of revenue.

54% of sellers find paid Social channels (especially popular among fashion-related categories) to be a viable medium to promote their products, even though the audience may have lower purchase intent.

Feed Marketing Report 2022 | DataFeedWatch

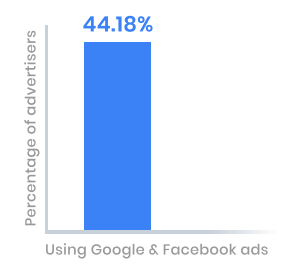

3. Over 44% of merchants advertise on both Google and Facebook

The fact that 44% of advertisers are placing product ads on both Google and Facebook (as of 2022) demonstrates the complementary nature of these two channels. Google is typically used to drive end-of-the-funnel conversions, while Facebook is used to increase brand awareness and encourage impulse purchases.

By utilizing this comprehensive approach, businesses can increase their revenue and strengthen their online presence in a competitive market. This indicates that advertisers are always looking for new ways to grow and reach more customers.

Feed Marketing Report 2022 | DataFeedWatch

4. 55.84% of online retailers send a different product set to Social and different to Search

In more than half of the cases, the number of products sent to Search and Social channels by the same advertiser is different. This is because not all products are suitable for all sales channels. Advertisers consider several factors when deciding which product sets to use for each channel. Search channels usually attract users who are looking for specific products, while social media platforms tend to attract users who are seeking inspiration.

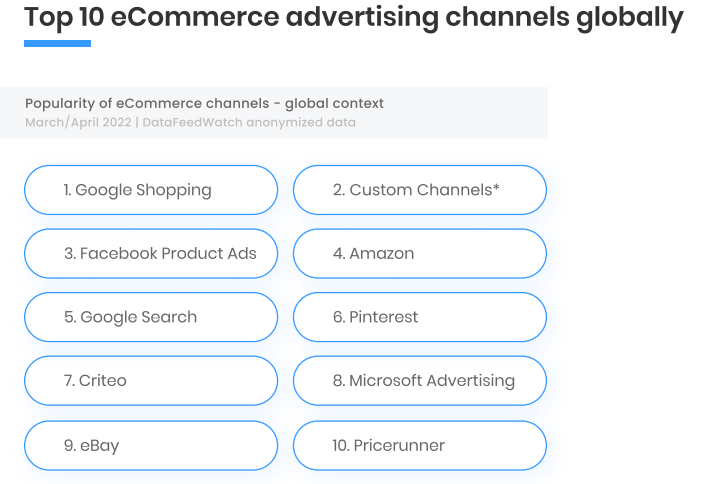

5. Facebook is the most popular Social channel for eCommerce

According to Feed Marketing Report 2022, Facebook is the social platform most often chosen by online advertisers to promote their products. In fact, it holds the steady second place in terms of popularity just behind Google Shopping in every product category. The second most used social platform for eCommerce is Pinterest, which is in the top 10 channels in many product categories such as Apparel & Accessories, Home & Garden or Furniture.

Instagram or Tiktok are as of today out of the 10 most used online selling platforms.

Google Ads Stats

Google Ads is one of the largest online advertising platforms in the world, connecting businesses with millions of potential customers. Whether it's search, display, video, or shopping ads, Google Ads provides a wide range of advertising opportunities to meet any marketing need. In this chapter, we will examine the latest statistics and trends on Google Ads. You will gain a better understanding of the impact that Google Ads can have on your business, and learn how to improve your advertising efforts.

All statistics are from Feed Marketing Report 2022 (except for 10 which comes from a case study).

6. Google Shopping is number 1 advertising channel in all product categories

Google Shopping is the king among online paid advertising and sales channels. In every single product category such as Apparel & Accessories, Electronics, Health & Beauty, Furniture etc. Google Shopping is the most frequently chosen platform by e-sellers.

And why is that? Google Shopping simply works great and most shoppers start their product search there.

Feed Marketing Report 2022 | DataFeedWatch

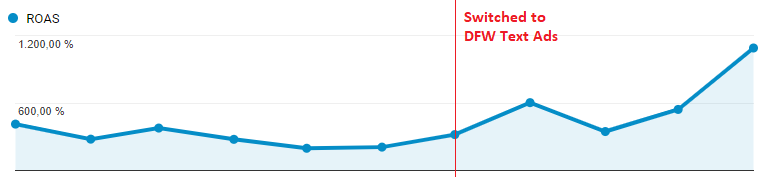

7. Excluding out-of-stock items from Google Search campaigns can result in a 181% increase in ROAS

Unlike Google Shopping or the new PMax campaigns, Google Search is not able to determine when something is out of stock. Therefore, not only is it crucial to ensure that your product data feed is always up to date with stock information, it’s also important to pause search campaigns that are advertising something unavailable. This budget can then be diverted to items that are in stock or the ad copy could be changed to advertise ‘pre-order’ options where available.

Digital agency River Online tested the exclusion strategy on their clients' Google Ads accounts and saw a 181% increase in ROAS. Check out their case study.

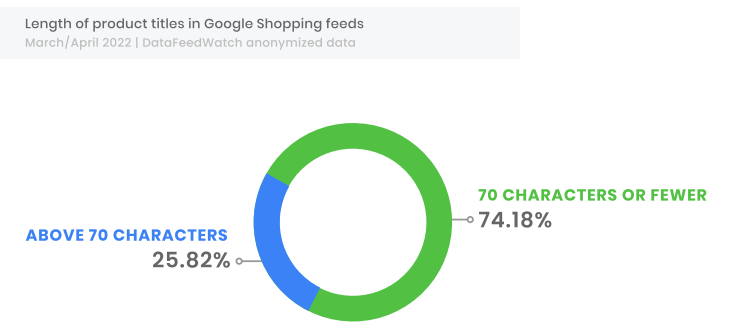

8. 1 in 4 products gets their title truncated in Shopping ads

Google Shopping product titles have a character limit of 150, but they are cut off after 70 characters. This means that 25.82% of titles across Shopping listings are on the longer side and important product data may not be visible. This can be a problem for businesses as it can lead to customers not being able to find the products they are looking for.

To ensure that customers can find the products they need, businesses should make sure that they front-load the product title with the most vital product details. This will ensure that all of the important product data is visible and customers can easily find the products they are looking for.

Feed Marketing Report 2022 | DataFeedWatch

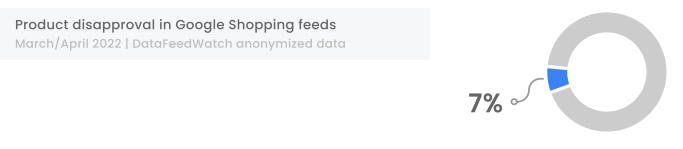

9. 7% of Google Shopping product listings are rejected by Google

As of 2022, 7% of all products included in Google Shopping feeds are rejected due to significant data errors. The most common issues occur with shipping settings, product images, and GTINs.

Feed Marketing Report 2022 | DataFeedWatch

Disapprovals of popular products and account suspensions due to error messages can significantly impact an advertiser's performance. To avoid product rejections, it's recommended to use a data feed tool to fix any errors before submitting the feed, and to familiarize yourself with the data requirements.

10. Clicks increase by +250% after optimizing top product titles

Many ad managers face the challenge of dealing with inadequate or incomplete data from stores. On average, 20% of merchants make significant changes to product attributes before submitting them to the ad platform. Of these, 14% are changes to titles, which are either rewritten or have words replaced to match consumer search patterns.

When done correctly, optimized titles can have a positive impact on impressions, click-through rate, and conversion rate. This overview provides insight into how to maximize the effectiveness of PPC campaigns.

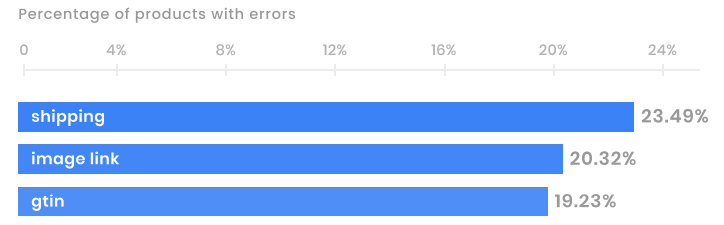

11. Shipping is the most common data error in Google Shopping feeds

According to the report's results, shipping is the most problematic aspect of setting up product data, making up 23.49% of all product rejections. The most common errors are too-high values submitted via [shipping_weight] as well as unspecified attributes (for example missing shipping country).

Feed Marketing Report 2022 | DataFeedWatch

Image attributes errors also contribute to 20.32% of rejections due to having several requirements. The most often repeated image errors include promotional overlays, images that are too small, missing or invalid images, and generic images.

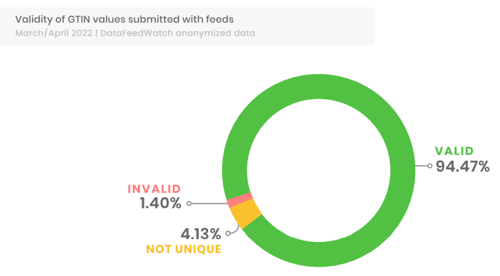

12. 5.5% of all submitted feeds have invalid GTIN

Submitting incorrect GTIN values results in a product listing disapproval by Google, while skipping GTINs is not penalized. A of 2022, this issue affects 5.53% of products with submitted GTINs and is caused by two types of problems: the repetition of identical GTINs for multiple products (affects 4.13% of products) and the submission of invalid GTINs (affects 1.4% of products).

Feed Marketing Report 2022 | DataFeedWatch

Removing GTINs from the feed (for affected items) is an immediate fix a merchant may use to make their listings eligible. If proper product identifiers exist, it is recommended to overwrite the flawed data with correct values for better ad performance.

eCommerce Stats

In this chapter, we will deep dive into the latest statistics and trends in eCommerce, exploring key areas such as product availability, sales, multichannel presence, and more. You will gain a comprehensive understanding of the current state of the eCommerce industry and its impact on businesses, both big and small.

All statistics are from Feed Marketing Report 2022 (except for 13).

13. Prices climbed 7.51% between 2021 to 2022

The price of products have increased significantly due to the supply chain disruptions caused by the covid-19 pandemic, forcing customers to become more sensible with their purchases and opt for the cheaper and discounted choices.

Source: Fred Economic Data: www.fred.stlouisfed.org

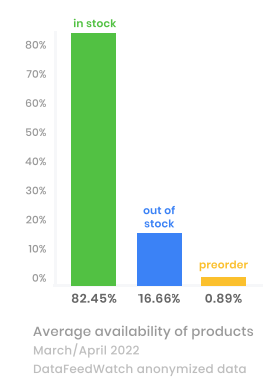

14. More than 16% of items listed in all catalogs were unavailable for purchase in 2022

Due to the global supply chain disruptions, many countries around the world had problems with product availability. There were a lot of online ads that were being displayed, when in fact the products were out of stock. On average, 16.66% of all advertised products were not available for sale during the first quarter of 2022.

Thankfully, popular eCommerce platforms, such as Google Shopping, automatically stop displaying ads for items that are not in stock to avoid a negative shopping experience. However, it’s worth checking the platform you are using as some PPC campaigns will continue running regardless.

Feed Marketing Report 2022 | DataFeedWatch

15. Just 0.89% of products in product feeds were marketed for ‘pre-order’

Pre-ordering can be an effective marketing strategy for businesses, as it allows customers to reserve a product before it is officially released or made available for purchase. This can generate buzz and excitement around a new product launch, and can also help businesses gauge demand and plan for production accordingly.

The low percentage of products being marketed as "pre-order" suggests that businesses may not be taking advantage of this strategy, or that they are only applying it to a small selection of products. This finding could also indicate that pre-ordering is not a popular demand among customers. It is important to note that this finding is based on the specific data feed and may not be indicative of the entire market.

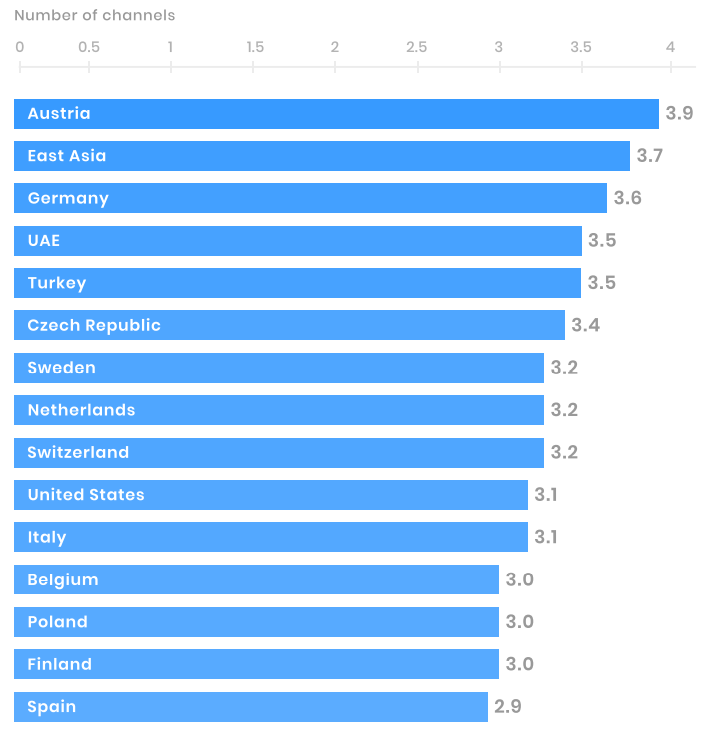

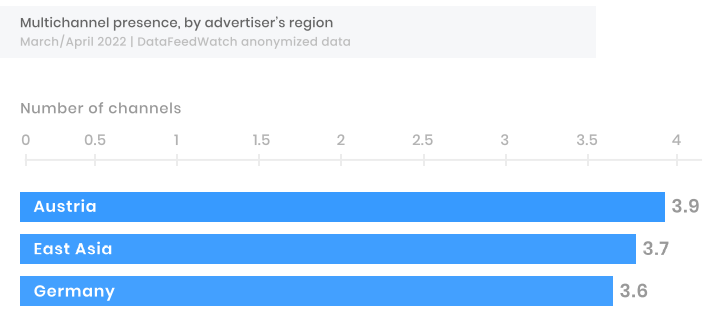

16. The average online merchant advertises on 3.2 channels

Regions such as DACH, East Asia, and UAE have developed an above-average online presence, as evidenced by the use of more than 3.2 channels by merchants. This suggests that the eCommerce market in these regions is more competitive, with multiple channels enjoying similar levels of popularity among online retailers. As opposed to a few dominant players controlling the market, there is a more level playing field among various eCommerce channels.

The usage of different channels can vary depending on the region and the local market. For example, in some regions, local marketplaces may be more popular among merchants compared to other channels. These marketplaces are specific to a particular country or region and are often used by merchants to reach a local audience. Similarly, social media channels that are popular in a particular region may also be used more frequently by merchants.

Feed Marketing Report 2022 | DataFeedWatch

17. 26.49% of the products promoted through paid channels are on sale

26.49% of all products advertised on paid channels were out of stock in 2022. There may be a few reasons why online retailers use discount strategies. First, companies want to remain competitive by offering discounts on products, especially in response to the disruption of the supply chain following the covid-19 pandemic. Second, there is a correlation between the number of products in stock and the number of discounts applied. Categories and countries that have more products in stock also have more discounts.

Feed Marketing Report 2022 | DataFeedWatch

18. 37% of the advertised inventory in the Apparel & Accessories category is on sale

The Apparel and Accessories sector leads in discount strategies with 36.98% products being on sale (2022).

The prevalence of discounts in certain sectors suggests that advertisers in these industries may be facing heightened price sensitivity among consumers, as well as heightened competition for the most desirable ad placements. This could be due to a variety of factors, such as the current economic climate, the availability of more affordable alternatives, or the increased presence of online advertising.

As a result, advertisers in these sectors may need to be more creative and strategic in their approach to advertising in order to stand out from the competition and capture the attention of potential customers. This could include offering more attractive discounts, creating more engaging content, or targeting specific audiences with tailored messages. Additionally, they may need to invest more in their ad campaigns in order to secure the best placements and maximize their reach.

19. 92% of advertisers choose to promote their products on a Search channel

Advertisers who limit their marketing efforts to a few channels often prioritize search-based comparison engines like Google Shopping. However, as the number of channels used increases, other types of platforms such as social media, affiliate networks, and niche sites become increasingly important. Of merchants who advertise on multiple channels, 70% focus on one country, while the remaining 30% expand their reach to other countries.

Feed Marketing Report 2022 | DataFeedWatch

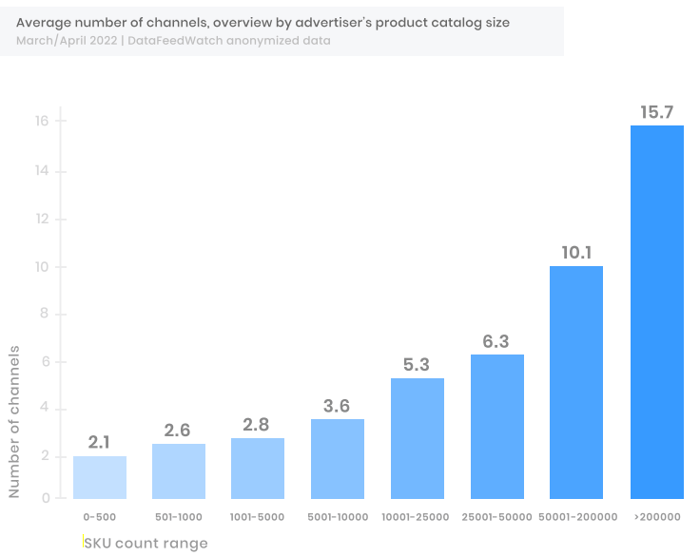

20. Stores with over 200,000 SKUs tend to advertise on 50% more channels than those within the 50,000 - 200,000 SKUs range

The number of channels a shop has a presence on increases with the size of their product offering. This is likely due to the amount of money they have available for advertising. Stores with more than 200,000 SKUs advertise on 50% more channels than those with 50,000 to 200,000 SKUs. However, there is only a small difference in the number of channels used by retailers with 1 to 5,000 SKUs, who advertise on an average of just over 2 channels.

Feed Marketing Report 2022 | DataFeedWatch

21. Home and Garden sectors are 22% above the eCommerce industry benchmark of 3.2 channels.

Retailers and brands in the category of advertisement use an average of 4 marketing channels, which is 22% higher than the eCommerce industry benchmark of 3.2 channels. The related category Furniture, is in third place with 3.4 channels, while the sector Electronics takes second place with 3.6 channels.

It is likely that the pandemic has had a positive effect on the multichannel growth of these three categories, as online consumer spending has increased. This could explain why they are ahead of the other categories in terms of multichannel strategy.

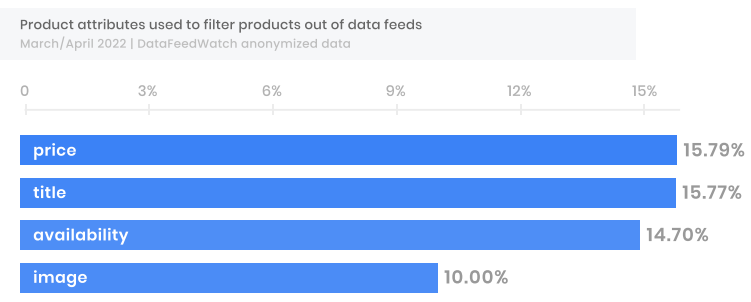

22. 64.74% of eCommerce marketers implement a product exclusion strategy

About 65% of eCommerce marketers implement a product exclusion strategy because directing paid traffic to all products in a store may not be profitable.This is because when a store sends paid traffic to all of its products, it is not able to target specific audiences or tailor its messaging to the needs of each individual product. As a result, the store may end up spending more money on advertising than it is able to generate in sales.

Nearly 16% of store owners remove products from their listing primarily due to their price, often because it falls below a certain limit.

Feed Marketing Report 2022 | DataFeedWatch

23. Only 10.94% of all online advertisers use Affiliate channels to promote their products

According to research on the channel types commonly used by e-sellers, affiliate channels appear to be an underutilized market opportunity in eCommerce 2022. Only 11% of online advertisers opt for these channels to market their products, despite the presence of various affiliate networks such as AWIN, Criteo, and CJ Affiliate. This appears to be a missed opportunity for e-commerce companies.

The research shows that affiliate marketing accounts for 16% of e-commerce sales in the US and Canada. Additionally, Google Trends data reveals a steady increase in interest in affiliate marketing over the last five years.

Keyword: affiliate marketing | Google Trends

24. English product listings make up 13 to 26% of all listings

English product ads are becoming increasingly popular in countries where English is not the primary language. This is due to the fact that English is the most widely spoken language in the world, and many people are familiar with it. As a result, companies are able to reach a larger audience by advertising in English.

The use of English in product ads has been shown to be effective in increasing sales. Studies have found that when English is used in product ads, the response rate is higher than when the primary language of the target country is used. This is likely due to the fact that English is more widely understood and can be more easily understood by a larger audience.

Local Advertising Stats

The worldwide spread of the COVID-19 virus that began in 2021 had a significant impact on the eCommerce industry in 2022. During the first half of the year, 16.66% of advertised items across all catalogs were unavailable for purchase due to being out of stock. Some countries handled the stock level disruptions better than others.

On a global scale, the average number of online channels used by an advertiser is 3.2. A high number of channels used by online retailers in a specific country suggests a more evenly distributed channel market share. In such cases, several eCommerce platforms have similar levels of popularity among merchants, and there’s no clearly dominant players. However, the situation varies from country to country.

Additionally, some countries, where English is not their primary language, use it in product feeds to reach a larger audience, for example non-native speakers in the targeted country. For retailers looking to expand their reach into foreign markets, non-native ads can be a great way to get started quickly. However, it is important to be aware that nonnative ads may have limited visibility potential and may result in lower conversion rates than ads served in the local language.

Let's see below some interesting eCommerce statistics for local markets. All statistics are from Feed Marketing Report 2022.

25. Nordics eCommerce stats

- Finland struggled with supply chain disruptions in 2022, with around 18.84% of advertised products being unavailable. Denmark did only slightly better with an average of 15.57% of products out of stock. Norway and Sweden handled the global supply chain disruptions very well with high levels of product availability and only 9.85% of advertised products being out of stock for Norway and 6.78% for Sweden.

- All Nordic countries take advantage of the possibility to run ad campaigns in English. In Finland 18.93% of product feeds are in English. In Norway and Sweden it is 18.56% and 17.79%, respectively. In Denmark, the percentage of English product feeds is slightly lower - 13.26%, but they run more ads in additional languages such as Norwegian, Swedish, Dutch than other Nordic countries.

- Sweden boasts the strongest multichannel presence among the Nordic countries, with 3.2 channels per advertiser. Finland comes next with 3.0 channels. The typical online retailer in Norway advertises on 2.5 channels, and in Denmark on 2.2 channels.

- The most popular local channels in the Nordic countries are:

Feed Marketing Report 2022 | DataFeedWatch

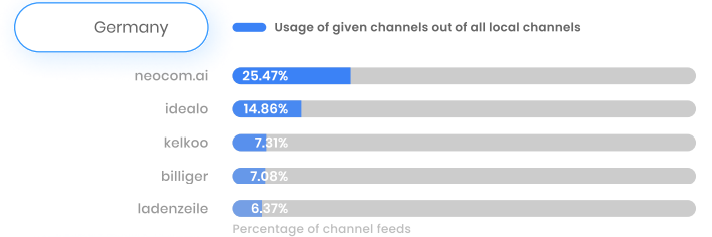

26. Germany eCommerce stats

- 16.62% of advertised products were unavailable in Germany in 2022 due to disruptions in the global supply chain. This is almost the same as the global average of 16.66% over the same period.

- 24.63% of product feeds reported in Germany are in English. This is a very high percentage, which may indicate a great potential in targeting audiences in this country with ads in a language other than German. It could also mean that many advertisers outside of Germany are trying to expand into this region.

- Germany has one of the strongest online presences of any market in the world. With about 3.6 channels per advertiser, it is only behind Austria (3.9) and East Asia (3.7) in the global ranking.

Feed Marketing Report 2022 | DataFeedWatch

- The most popular local advertising channel in Germany is neocom.ai, which is used by 25.47% of advertising companies that choose to implement local advertising strategies.

Feed Marketing Report 2022 | DataFeedWatch

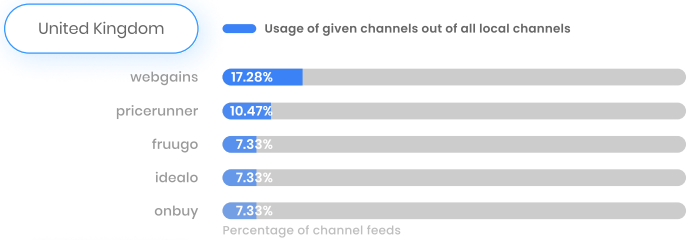

27. United Kingdom eCommerce stats

- 14.72% of advertised products were out of stock in the UK in 2022, which is below the global average of 16.66%. This means that they have done quite well on the product availability issue compared to other countries.

- British advertisers are not very good at expanding into multiple sales channels. The typical online retailer in the UK advertises on 2.1 channels, which is far from the global average of 3.2.

- The UK has several popular local eCommerce platforms, with Webgains being the most widely used channel.

Feed Marketing Report 2022 | DataFeedWatch

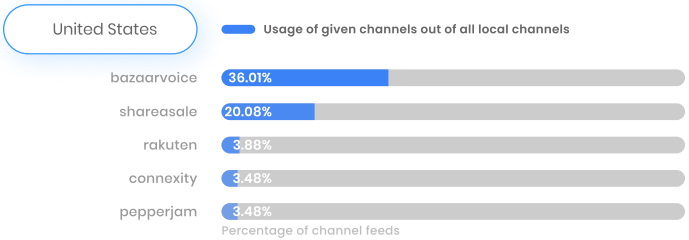

28. United States eCommerce stats

- In 2022, 14.28% of advertised products in the US were not available for sale. This is a good result, below the global average of 16.66%. Moreover, the US market was among the most affectedby supply chain disruptions by August 2021, so they have made great progress within a year.

- A typical online retailer in the USA advertises on 3.1 channels, which is only a bit behind the global average of 3.2.

- It is not surprising that English is the main language of the product feed used in the US. It accounts for 82.52% of all ads.

- Two main advertising and sales channels are used in the USA: bazaarvoice and shareasale. They are used by 36.01% and 20.08% of advertisers in the country, respectively.

Feed Marketing Report 2022 | DataFeedWatch

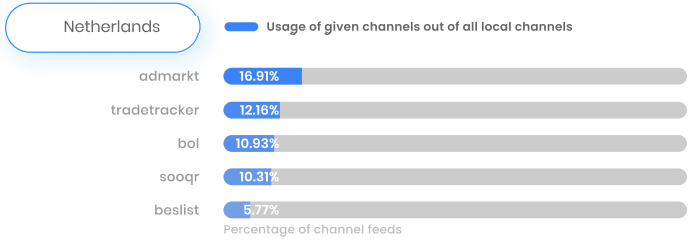

29. Netherlands eCommerce stats

- The Netherlands has really handled the supply chain problems well in 2022. Only 9.37% of advertised products were out of stock last year, an excellent result.

- Most Dutch people can speak English well, and 14.93% of all product feeds submitted in the Netherlands are actually submitted in that language.

- Advertisers in the Netherlands have a fairly strong multichannel presence, with the average number of channels used by a single online retailer at 3.2. With this result, they hit the global average exactly.

- In the Netherlands, there is an even use of local sales channels, but admarkt is the most popular.

Feed Marketing Report 2022 | DataFeedWatch

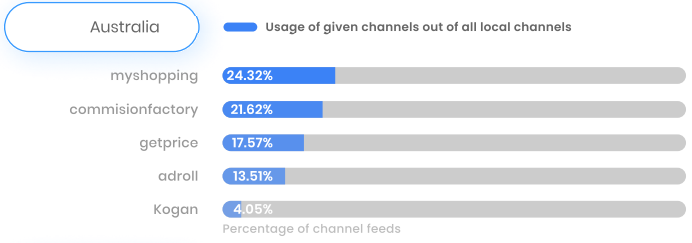

30. Australia eCommerce stats

- 22.65% of products advertised in Australia were out of stock in 2022 due to disruptions in the global supply chain. This means that this country was one of those that struggled a lot with product availability, more than most other countries. The average level of out-of-stock products in 2022 was 16.66%.

- A typical online retailer in Australia advertises on 2.5 channels, which means they prefer to promote their products on a smaller number of platforms. This number is lower than the global average of 3.2

- Australia has 4 local advertising/sales channels, which are quite popular. The most commonly used are myshopping and commisionfactory.

Feed Marketing Report 2022 | DataFeedWatch

Conclusion

eCommerce advertising is a critical component of any online business and encompasses a vast array of strategies and tools that businesses can use to reach and engage with their target audience. To achieve success in eCommerce advertising, businesses must take into account a range of factors such as stock availability, discounts and promotions, online shopping trends, multichannel advertising, feed optimization, location, and language. By staying current with the latest eCommerce and PPC statistics and trends, businesses can increase their visibility, drive sales, and ultimately grow their business.

Ecommerce statistics and trends play a crucial role in digital advertising trends and are a constant area of evolution. Keeping up-to-date with the latest eCommerce statistics is essential for businesses looking to reach and engage with their target audience. The statistics and trends of eCommerce advertising can help businesses understand the ever-changing digital landscape, and this information can be used to inform their advertising efforts.