The economic disruptions caused by the new virus are being reflected in eCommerce. Decreased valuations and increased market fluidity are a common occurrence in most sectors. But in times where many areas of business are struggling, there are opportunities for others to flourish. One area of business that is helping economies stay afloat is eCommerce.

The Coronavirus pandemic has put eCommerce at the forefront of retail. For better or for worse, no industry has gone untouched by COVID-19. Overall, eCommerce seems to be in a pretty good place during the Coronavirus. Customers who can’t go to a brick-and-mortar store may shop online instead. But as always, nothing is just that simple.

The pandemic also highlighted the importance of digital transformation. Retailers with a strong eCommerce strategy have more flexibility than their traditional counterparts and therefore have a better chance of surviving supply chain disruptions.

And as Amit Ray once said, “Every challenge comes with rainbows and lights to conquer it.”

So how exactly is Coronavirus changing the current eCommerce landscape? And how will things look in the long term? Let's take a deep dive into data, predictions and some tips on how to adapt your business to the new reality.

How Coronavirus is Changing the eCommerce Landscape

Coronavirus vs. eCommerce - The Latest Picture

eCommerce Sales

COVID-19 - Amazon Data & Traffic

Coronavirus- Behavioral Impacts

COVID-19 Boosts ‘Buy Online, Pick up In Store’

COVID-19 - Opportunities and Challenges for eCommerce

Opportunities for eCommerce during Coronavirus Pandemic

Challenges for eCommerce during Coronavirus Pandemic

COVID-19 Disruption - Strategic Takeaways for Online Retailers and Advertisers

Practical Tips for Your Campaigns in the Age of Coronavirus

What Can We Learn from Previous Pandemics

What Should Consumers Expect - 5 Post-pandemic Predictions for eCommerce

Conclusion

Coronavirus vs. eCommerce - The Latest Picture

eCommerce Sales

The data provides the latest picture of how the Coronavirus pandemic has accelerated the transition to online shopping. Meanwhile, total retail sales continued to decline in the second quarter.

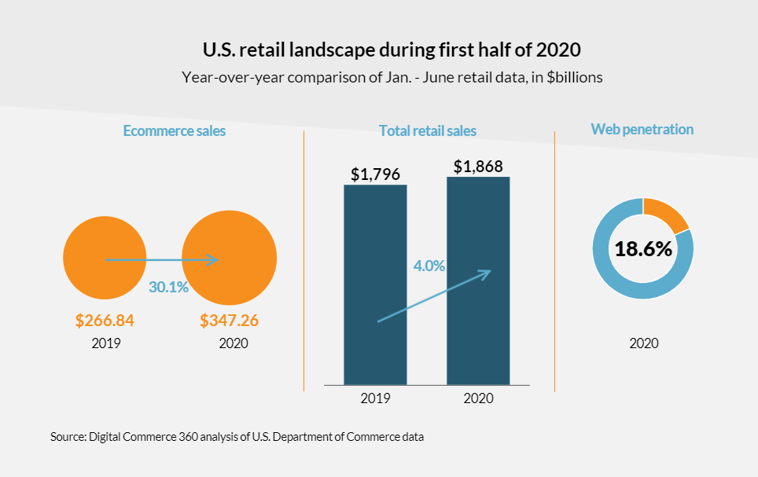

According to the latest Digital Commerce 360 analysis of U.S. Department of Commerce data:

- Consumers spent $ 347.26 billion in online stores with US sellers in the first six months of the year, up 30.1% from $ 266.84 billion over the same period in 2019

- For comparison, eCommerce sales in the first half of 2019 increased by just 12.7% year-on-year.

- Online spending accounted for 18.6% of total retail sales in the first two quarters of 2020.

- Consumers spent $ 211.5 billion on eCommerce in the second quarter, up 31.8% quarter-on-quarter according to figures published by the US Census Bureau.

The July census shows that online shopping continues to grow among consumers, even though many companies have reopened their doors.

- Total retail sales continued to decline in the second quarter, declining 3.9% compared to the first quarter of 2020, while total retail sales fell 1.3% compared to the fourth quarter of 2019

Not surprisingly, major retailers such as Amazon, Walmart and Target have benefited from the rapid transition to eCommerce during the pandemic.

COVID-19 - Amazon Data & Traffic

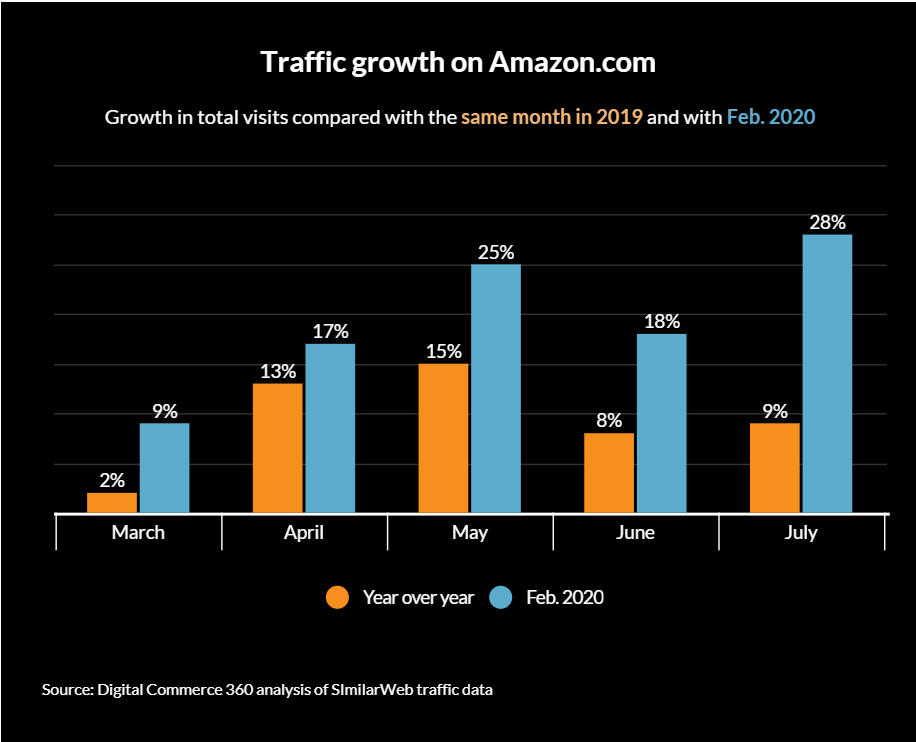

- Amazon.com Inc. continues to see increased traffic to its site even as statewide stay-at-home orders lift and stores reopen.

- In July, site traffic was up 28.1% compared with February 2020 and up 8.7% year over year.

It’s important to note that traffic is up year over year despite Amazon postponing its annual Prime Day sales event, which was held in July 2019, to the fall in 2020.

- Amazon, naturally, has benefited from the shift to digital with its recent record quarterly profit and 40% sales growth.

- Consumers now spend approximately $11,000 per second on Amazon

Coronavirus - Behavioral Impacts

Coronavirus hit the world before anybody really knew what was happening. New laws and rules were put into place. Suddenly, the world was a different place. This led to a stage of panic in many countries. Yet, as people adapted to their new enforced lifestyles, panic purchases slowed in many nations. The result was only a minor change in sales patterns.

This is further highlighted in Nielsen’s study of the U.S. market. The study shows how quickly consumers processed the new information on COVID-19, and then altered their purchases processes.

Changes in purchasing behavior were also noted due to social distancing. Nearly half (47.2%) of US internet users were avoiding shopping centers and malls. If the fallout takes a turn to the worse, roughly three-quarters (74.6%) stated they will steer clear from shopping centers altogether.

The percentage of digital sales is fluctuating between sectors. One example of this is electronics, which at some point was at 42.7%. Whereas auto & parts at 3.9%. Grocery delivery is also seeing large boosts due to consumer concerns regarding stores.

Advertising spend has also seen a decrease in sectors such as entertainment, retail, and FMCG. This change is largely due to cinema’s and other similar forms of entertainment ceasing to operate due to the virus. In contrast, this has seen a rise in the use of online, on demand media services, such as Amazon Prime, Netflix and Disney+.

These drastic behavioral changes are indicative of current conditions. And while it may be difficult to measure how long these conditions will endure, businesses are being forced to adapt.

Especially because 51% of global holiday shoppers plan to shop locally during the 2020 holiday period. An additional 48% say the majority of purchases will turn to the markets, showing a split in consumer priorities as the end of an uncertain year for retail.

Supply chains are being pushed to their limits, whilst new short-term and long-term tactics are being developed. Many companies are already considering post-pandemic strategies using thoughtful tracking processes.

COVID-19 Boosts ‘Buy Online, Pick up In Store’

As eCommerce grows, many retailers are encouraging customers to consider cheaper shipping options like BOPIS to keep these costs in check. Costs associated with both last-stage delivery and returns can have a significant impact on retail margins.

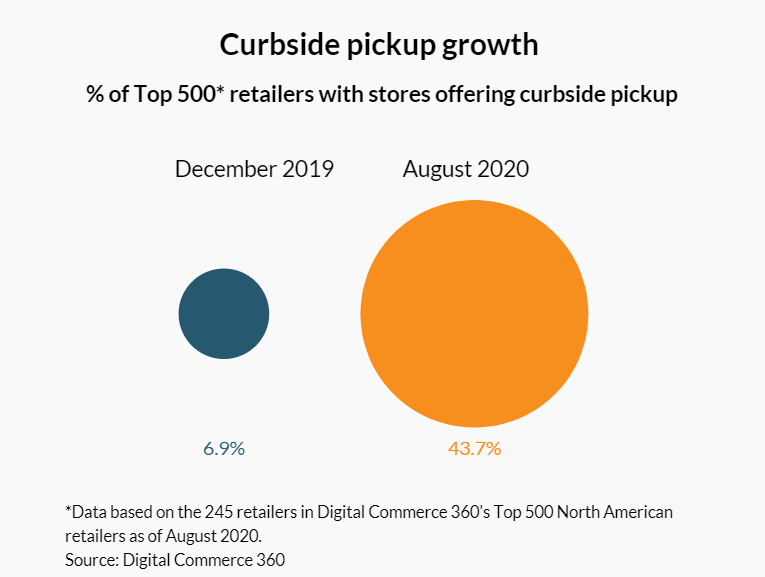

Digital initiatives such as BOPIS (Buy Online, Pick Up in Store) have been key for big box sellers during the pandemic. BJ Wholesale has announced major plans to expand these initiatives after recording 300% digital growth annually. Increase in BOPIS orders by 208% April (y / y) is another sign that people are trying to reduce their exposure to the Coronavirus by reducing the time spent in the store. BOPIS traffic increase under normal conditions creates an opportunity for additional purchases and allows customers to return the goods in the store.

Many retailers work with carriers to extend the coverage of pickup locations. Like Walmart which has allowed customers to collect online orders from FedEx locations. As retail chains are adopting BOPIS more and more, it can easily become the basis for implementation as the Coronavirus curve flattens.

Pandemics hopefully will fade, but eCommerce will remain

The effects of the current status quo can last a long time. One of them may be the sustained development of eCommerce, as a result of consumers hesitate to return to in-store purchases. Retailers can win in the long run by looking at eCommerce as a key sales channel and identifying how they can improve multi-channel order fulfillment.

Back to the top or download the Ultimate Guide to Data Feed Optimization

COVID-19 - Opportunities and Challenges for eCommerce

According to US government, online sales in Q4 of 2019 were 11.4% of total retail spending. The forecast for eCommerce in 2020 estimates that level may rise to 12% due to the impact of Coronavirus.

This observation is indicative of current consumer behavioral patterns. It also highlights how trends can be determined by the fluctuating situation.

At the present time, nobody can predict the full-blown impact of coronavirus on the global economy. But it is still possible to identify opportunities, even in a disrupted market.

Opportunities for eCommerce During Coronavirus Pandemic

- Consumers will shift towards online purchasing, to avoid public places. Services such as home delivery, and brands like Amazon will flourish. And the online divisions of major retailers will become major beneficiaries.

- Consumers who purchased online during the holiday season were observed to repeat this buying pattern post-holiday. This highlights that consumers may return to the same purchasing process again, and may do so after the Coronavirus pandemic.

- As observed in some parts of China, there’s less competition for advertisers still committed to running campaigns. However, currently these advertisers are running outdated advertisements that aren’t relative to the situation. If the campaigns are altered to the current social environment, they could be more fruitful.

Challenges for eCommerce During the Coronavirus Pandemic

Like with most scenarios, with opportunity comes challenges. Taking an attentive look may help eCommerce to mitigate the expected recession. Challenges that need to be mulled over with the same concern. Some examples of potential issues are:

- Supply chain issues - product shortages and potentially declining consumer demand could also blunt e-commerce growth – if the economy falters or goes into recession.

- Creating convenient ways for people to shop with pick-up, drive-up, and same-day delivery.

- The surge in online orders heaps pressure on businesses to fulfill them. In some instances, this pressure is getting too much for businesses and threatens to upend their e-commerce operations.

COVID-19 Disruption - Strategic Takeaways for Online Retailers and Advertisers

1. Look ahead and reframe your efforts.

Make a crisis plan and response. Pay attention to your strategies, including your strategy for post-Coronavirus. This process must be fast and needs to react to evolving circumstances.

2. Shift your sales channel mix

Person-to-person and bricks-and-mortar retail are already restricted in affected regions. Redeploy sales efforts to new channels both in B2C and B2B enterprises. If you’re selling onsite only, consider transferring your business online. If you’re already active online, utilize additional marketplaces (Amazon, eBay, Bol or other).

Get creative on social media. Stay engaged with communities and support people in difficult times. They will appreciate this and may reciprocate when in a position to do so.

3. Respond to new needs with innovation

New customer needs will also create the requirement for innovation. When threatened by crisis, many companies will be focused on defensive moves, but it’s wiser to focus your attention around emerging opportunities.

4. Utilize all your assets to stimulate and sustain demand

Maintain or even boost digital marketing efforts for the foreseeable future. Social selling seems to be a better idea than push marketing at the moment.

5. Reconsider your discount strategy

Discounts don’t have to be drastic to entice consumers. Utilize smaller sales and category specific promotions.

Back to the top or download the Ultimate Guide to Data Feed OptimizationPractical Tips for Your Campaigns in the Age of Coronavirus

Plenty of worldwide phenomena affect PPC performance. Coronavirus is no exception.

Measurement strategies and goals should be adjusted for uncertain times. It is also a prime opportunity to build long term relationships with customers for the future.

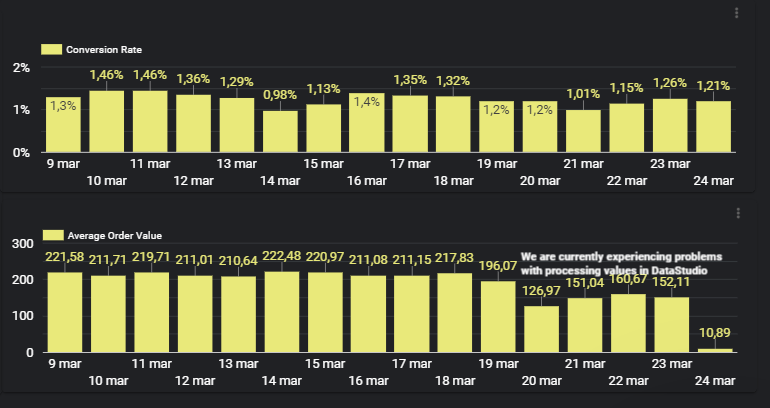

source: blog.edrone.me, data from March 25th 2020

source: blog.edrone.me, data from March 25th 2020

Data comes from edrone customers, amounts and values have been changed to reflect trend, but not show actual volumes.

1. Revisit your negative keywords list

With consumer behavior and searches changing so rapidly, you may find yourself showing ads for new search queries. These queries may not necessarily convert all that well. It is especially important now to wisely allocate your advertising budget and not waste money on terms that will drown your money.

Go head and check your search terms report and make sure to add the non converting terms to your negative keywords list.

2. Focus on bottom-of-the-funnel channels/advertising

Rapidly changing customer behavior and increasing uncertainty places brand awareness campaigns at a disadvantage. It’s recommended to focus on the bottom of the funnel.

- Go with Facebook retargeting and show your ads to people who already viewed your products in your store.

- Utilize Customer Match audiences in Google

- Identify the local channels that have a high trust level among consumers

3. Keep an eye on automated bidding

The automated bidding is using smart algorithms to decide on bid optimization. The only problem is that the algorithm has learned from the ‘regular’ situation, not a crisis situation. In order to avoid trouble make sure either place strict budget cups or consider switching to manual bidding for the time.

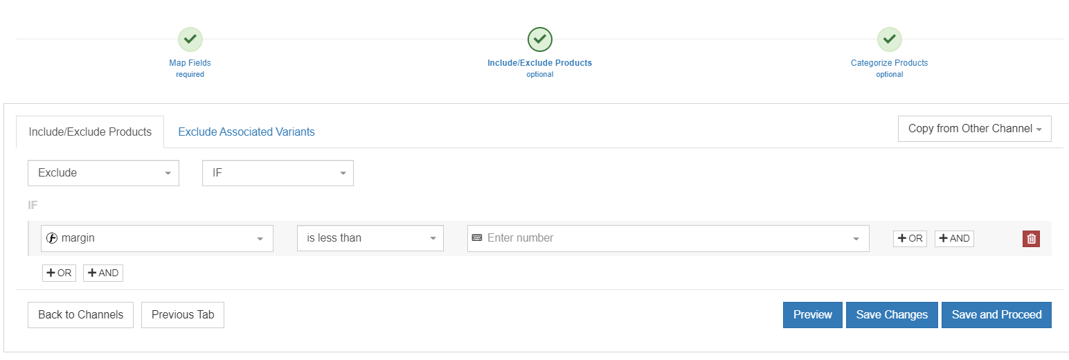

4. Revise your advertising portfolio

Focus on the products that will convert and will drive the ROI for you, exclude other products from the feeds.

5. Take device preferences into consideration

People are staying at home and they may use their PC a bit more than their mobile. Make sure to include this in your strategy and optimize budget allocation per device.

What we Can Learn from Past Pandemics

The Coronavirus isn’t the first time these sorts of disruptions have hit retailers and their customers. Long before this outbreak, the SARS virus in 2003 was a turning point for eCommerce.

In 2003, Chinese pioneers Alibaba and JD.com faced and overcame the challenge. This could be used as inspiration for online retailers now.

- JD.com resorted to selling electronics on internet forums and QQ chat groups. Later the bulk of resources were devoted to the online business. This ensured growth and allowed the brand to become China’s largest online retailer of electronic products.

- Alibaba’s B2B e-commerce business thrived after foreign businessmen cancelled trips to China. This is how registering on its platform began. The experience partly led to the birth of Taobao, which surpassed eBay to become the largest C2C marketplace in China.

The sector might've been relatively primitive back then, but the outbreak made many retailers turn to the online platforms that hadn’t been forced to close.

Back to the top or download the Ultimate Guide to Data Feed Optimization

What Should Consumers Expect - 5 Post-pandemic Predictions for eCommerce

It is still difficult to anticipate the full impact of the Coronavirus on overall online sales growth rates.What is certain here is that the results will not be consistent across all fields. This will depend on, among other things, the niche, changing buyer behavior, and how long communities will have to keep the social distance.

.

The low-touch economy will survive and eCommerce will continue to benefit.

The eCommerce industry has already almost doubled year-on-year compared to 2019. Even after COVID-19 has subsided, people subconsciously will avoid risk by not going shopping in-person.

Every business will find a way to sell online

Businesses without online stores were forced to adapt and transit their brick-and-mortar online. In the post-COVID-19 era, companies won't make the same mistake twice.

Creating a functional website where consumers can spend (or donate) as a safeguard against another potential outbreak will be crucial to determine success.

The most successful eCommerce companies will hold onto their supply chains firmly.

As an example, Thrive Market with DTC was forced to cut orders as demand soared and the 2-3 day delivery promise grew to 2-3 weeks. Huge delivery delays were a major side effect of the onset of COVID-19, and many companies did not anticipate the mere impact on demand as they would see it.

Owned eCommerce channels will play a bigger role than before.

When Amazon focused solely on delivering only essentials in March, it left Amazon-dependent sellers relying on their fulfillment services in the dark. It is still worth it to sell on multiple marketplaces but those who sell on their own site will manage better and might have greater success being independent.

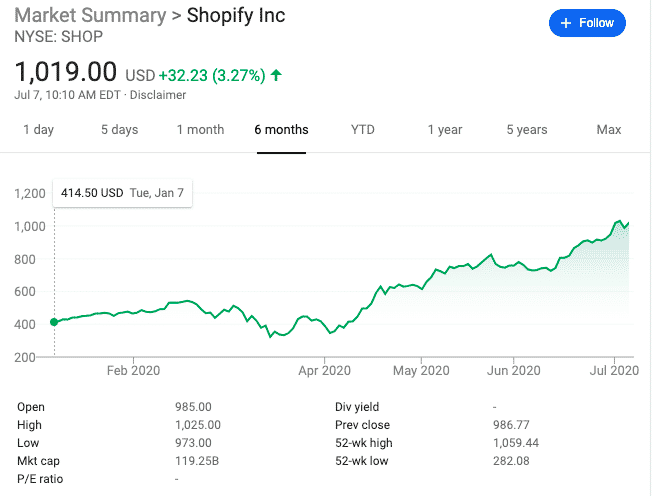

Shopify's dominance will continue to grow and will pose an increasing threat to Amazon's eCommerce market share.

Between March and June 2020, Shopify made significant progress in its strategic partnerships. This collaboration will allow Shopify to gain a greater market share compared to eCommerce giant Amazon.

source: getmatcha.com

source: getmatcha.com

Back to the top or download the Ultimate Guide to Data Feed Optimization

Conclusion

Coronavirus has created new challenges for many online businesses. We have observed growing concerns regarding people and companies that are exposed to financial risk. From loss of profit, to loss of employment, the pandemic is influencing all areas of both life and business.

But still, some companies appear well-positioned to benefit from the shifts in consumer behavior caused by the outbreak. Perhaps this is simply a time for companies to shift their focus, rather than panic. There are still opportunities available, they just need to be recognized and put to use.

With the easing of restrictions on the Covid-19 pandemic, forward-thinking retailers will learn from others and embrace digitization by moving to an omnichannel model. More frequent disruptions in the supply chain together with growing customer expectations, and competition in the market leave them with no other choice.

COVID-19 has had a significant impact on businesses around the world. Many will struggle to recover. Even so, some sectors may still experience a business boom.

We are going to monitor, update and share new insights on a regular basis. Our goal is to help merchants grow, especially during these challenging times.

Please don’t hesitate to reach our support team and let us know if we might help you in any way.

Learn more about the impact of COVID-19 and how to adjust your strategy:

- 5 Tips to Increase Sales After the COVID-19 Pandemic

- 4 ways to advertise for free during the COVID-19 pandemic

- How Big Brands Reacted to the COVID-19 Pandemic

- COVID-19: 7 Shopping Channels Offering Discounts to Retailers

- How to Move your Brick and Mortar to Online

- How to Profit Big Time with Google Shopping CSS [up to 20% discount for clicks]