As 2023 comes to a close, advertisers and retailers are gearing up for the highly anticipated end-of-year sales. In this article, we will explore the important dates to look out for. You'll gain tips and strategies to effectively prepare your eCommerce campaigns for these sales events.

Whether it's creating a discount strategy, understanding your customer base, or optimizing your product feeds, this article will guide you through the necessary steps to ensure a successful and profitable holiday season. So, get ready to make the most out of Black Friday and the holiday sales by implementing these valuable tips and strategies!

Get your own copy of the Black Friday 2023 Guide

Download this guide to take it with you on the go - access these tactics again at any time.

Holidays Calendar 2023

First things first. What are the dates we need to look out for?

- Black Friday: November 24th, 2023

- Cyber Monday: November 27th, 2023

- Christmas Day: December 25th, 2023

- Boxing Day: December 26th, 2023

But this is not all.

- Thanksgiving: November 23th, 2023

- St. Lucia's Day, popular in northern Europe and Italy, December 13th

Get your discount strategy right

Just the day after Thanksgiving, the most important event on the calendar is Black Friday. Like every year, shoppers expect great deals and discounts. But simply decreasing prices is not always the right thing to do. First, ask yourself the following questions to identify the right sale strategy.

Creating a discount strategy for Black Friday and the 2023 holiday season:

- What is the overall goal of the sale? Increase revenue, increase margin, get rid of unsold stock, promote new products, etc.?

Each objective requires a specific strategy. Setting a goal as the first step of creating your discount strategy will give you a clear direction to go in for all of the following decisions you need to make. - Which product categories do you want to discount and why?

Simply discounting all of your products may make your brand appear cheap and give less value to what you're selling overall. Instead, be strategic with which products you choose to discount. For example, you may want leverage yourself over competitors, bring awareness to an item, or get rid of extra inventory. - Who is your Black Friday customer base? Is it your usual audience, or maybe general bargain hunters? Is it an opportunity to gain new customers or a risk to lose regular ones?

Knowing exactly who your customers are will allow you to shape and tailor how you communicate with them. It will also build brand loyalty and prevent customers from only shopping with you when products are discounted. - How do customers interact with your business? Do they buy in-store or online, or both?

By determining how customers (new and returning) interact with your business, you can segment them into groups and personalize the discounts they receive. - Does your discount add value to your brand image, or rather does it harm it?

Like we mentioned earlier with not wanting to discount all of your products at once, you want to make sure the strategy you use is adding value to your brand. If your brand is higher end and you don't want to discount items at all, you can take a different approach. In this case you could create a promotion where customers receive a free gift after spending a certain amount of money. - Can you still maintain profitability with the discount?

Your discount strategy should align with your business goals and help you more than it hurts. If you're worried about the end results, there are some things you can do like reducing marketing costs and focusing on customer retention.

To know more about discount strategies, read our blog post 6 Things to Consider For Your Next Discount Strategy.

How to Prepare for Black Friday 2023, in Google Shopping, and more.

If you're reading this post you know already the importance of product feeds for eCommerce businesses. Making sure your feeds and campaigns are in order is always important, but it is even more around this time of the year.

October and November is the time where you really need to focus your efforts on making your feed strategy bulletproof. Or, even better, Black-Friday proof. In fact, Black Friday and the holiday season, in general, is short and nothing should go wrong!

1. Product data audit

Make sure your product data is correct and reflects exactly what you're showing on the website. Make sure there aren't any missing images and every product has all relevant information.

Original Price, Sale Price, GTIN, Additional Images, are just a few of the product information you might be overlooking but are super essential for Black Friday. Remember the power of supplemental feeds when it comes to adding extra information to your product feeds.

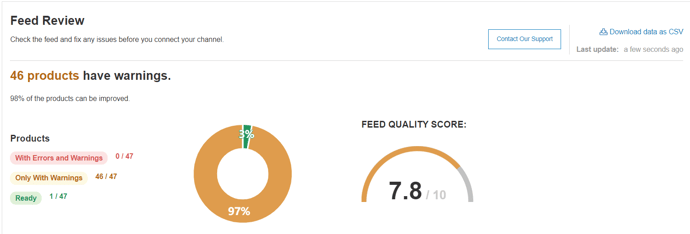

Identifying feed issues

Troubleshooting issues in your feed becomes a whole lot easier if you know where to look. There are a couple of tools that can help.

DataFeedWatch Feed Review

One way is using DataFeedWatch to perform a full feed check. This allows you to avoid errors completely before sending your feed off to the channel you're selling on. It will check your feed for the following:

- Any missing data (both required and optional)

- If your products have unique identifiers

- If your GTINs are valid

- If attributes with pre-defined values are correctly mapped

You'll then get a feed score out of 10, along with steps to fixing each error or warning.

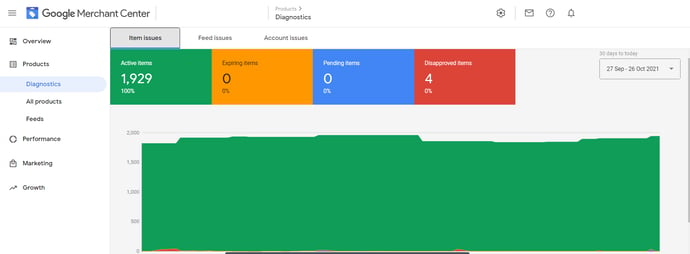

Diagnostics via Google Merchant Center

There's a separate section in Google Merchant Center called Diagnostics that will give you a detailed report about any issues found across your feeds or account. You'll then need to take care of any errors, warnings, or notifications to improve the quality of your feed.

You May Also Find Interesting: 35 Common Merchant Center Errors + How to Fix Them

2. Schedule multiple updates

During the holiday season, your inventory is going to be selling out fast. Because of that, it's important for you to get as many updates as possible so that your feed is always fresh.

For example, if an item goes out of stock then you want to make sure that information is passed to Google as soon as possible. You can do this by setting up multiple feed updates per day if you are using data feed management software, like DataFeedWatch, for example.

This will give you peace of mind during the busiest eCommerce season of the year knowing that your inventory is good and you're not advertising out-of-stock products. It also helps if you make any changes in your feed, because they will be automatically reflected in your ads once the update takes place.

To test DataFeedWatch for FREE - select your feed management plan here.

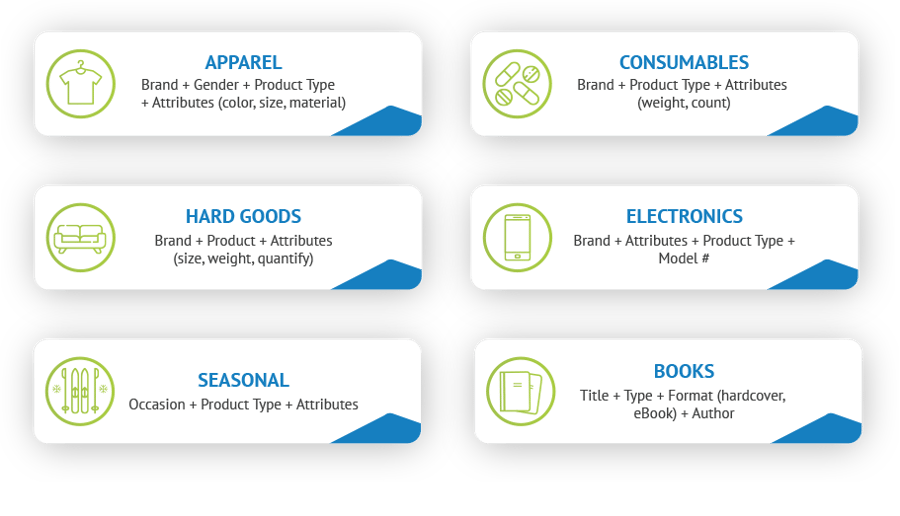

3. Optimize product titles for performance

We'll never stop reminding our readers of the importance of product titles in data feeds. The product title is the most prominent piece of information your prospective customers will see in your ads. Make sure they're optimized for success following our infographic:

Additional best practices for high-converting product titles are:

- Using Google Ads search term reports gathering queries that perform well and result in conversions.

- Adding relevant keywords to your titles and putting the most important ones first.

- Make titles as specific as possible with modifiers like size, color, material, etc.

- Add brands and product categories to your titles to leverage brand loyalty

- Test, test, test! Optimize and refine your titles to find out what works best.

4. Optimize product descriptions

Although product descriptions are not usually visible in shopping ads, it is still worth optimizing them as Google uses them for ranking and sorting purposes.

However, if you're also running Search ads or listings on channels where the description is visible, then it's even more important. There are a few things you can keep in mind to ensure your descriptions satisfy a shopper's search. They are:

- Creating descriptions with your buyer persona at the forefront. What information that isn't in the title would they like to know right away about your product?

- Mirror the language your customers use to talk about your products while also staying true to your brand's voice.

- What does your target audience need? Let them know about the benefits of your products without being too sales-y.

- Do keyword research to optimize for search engines.

- Make sure it's easily readable.

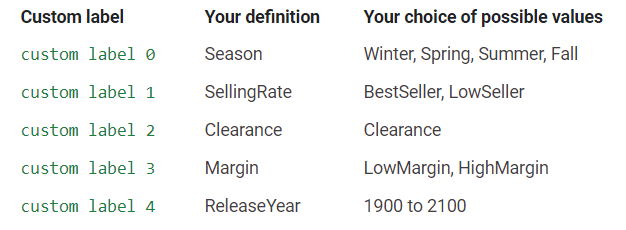

5. If you don't already, now it is time to use custom labels

Custom Labels are custom fields that you can add to your feed. They can contain any piece of product information you want and are used to segment your feed in Google Shopping Campaigns. For example, you might want to enter the product margin in a custom label. Or maybe, the supplier name or the remaining stock.

There are many ways to use Custom Labels, so we summarized how to get the most out of them in our article 15 Examples of Profit-Making Custom Labels for Google Shopping. But for now, take note of the following examples that are very relevant for Black Friday and the holiday season:

- Enter a label for a specific promotion or discount level. Maybe you have different discount levels being advertised at the same time. In this case, it could be helpful to be able to segment your product feed based on their discount, so you can better optimize your campaigns.

- Enter the price range of a product. This way you will be able to segment your products by price range and use different strategies based on that.

- Enter the profit margin. Maybe your campaign objective is to maximize profit rather than revenue volume. Being able to segment your feed based on product margin will definitely help achieve this goal.

- Enter the product priority. This is useful if there are products that you want to sell first or anyway to prioritize. It could be the case if you have unsold stock to get rid of.

You can easily manage your custom labels using Google shopping optimization software like DataFeedWatch.

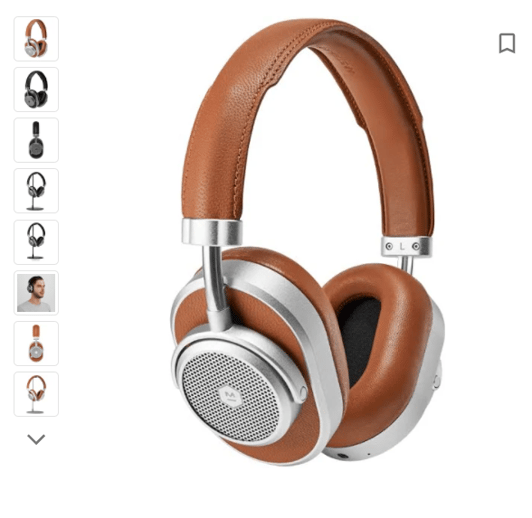

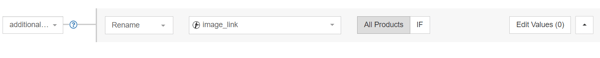

6. Optimize your images and use additional images

Images are also essential for any shopping campaign. In fact, this is also a prominent part of a product ad. Therefore, make sure your images are strong and match the product they're advertising. Also, make sure each product variant has its own image.

Plus, add more than one image per product if you can. Google Shopping allows for additional images and we can't stress enough how important this feature is.

To know more, we had summarized the 7 Rules To Abide By with your Google Shopping Images.

It's easy to add additional images through the optional attribute 'additional_image_link' in your feed. You can add up to 10 extra images.

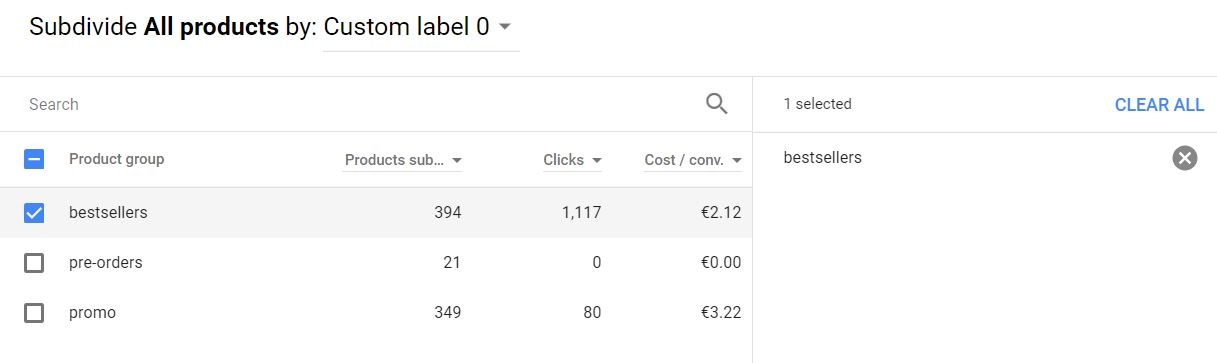

7. Optimize your campaign structure and bids

Now comes the fun part: How to best optimize your campaigns

You can use custom labels and the DataFeedWatch “is in list” function to accomplish this. With that, you'll be able to assign a label of your choice to a list of handpicked products from your store.

Here are 4 examples:

- You have several different promos running at the same time during the Black Friday week. Maybe 50% off headphones, 20% off TVs, 15% off Hi-Fis, and so on. You want to put all those products in separate product groups so you can optimize bids accordingly.

- There is a clearance stock to get rid of. You can use supplemental feeds to put these products in the same product group so you can bid more aggressively on them, hoping to increase sales.

- There are some products that you know your competitors are not stocking. Well, you definitely want to increase the bids on them so you maximize the exposure and steal business from the competition.

- On the other hand, you might have many low-margin and bad-performing products you want to spend as little as possible on. Group them together through a supplemental feed and lower the bids.

8. Optimize your pricing

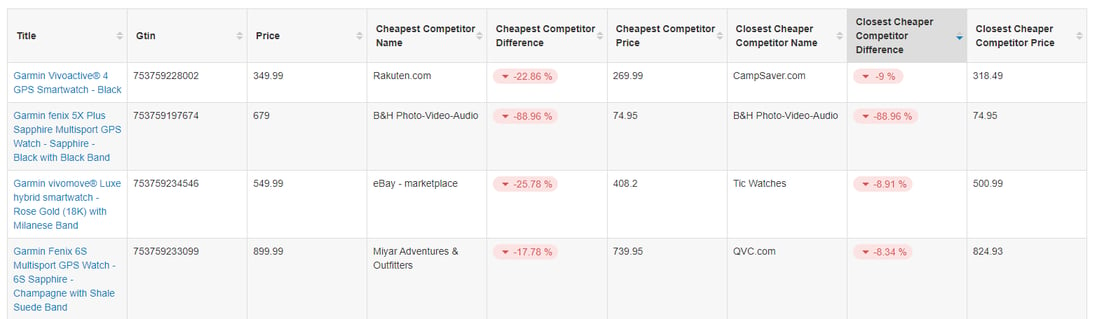

When it comes to Black Friday, it's all about pricing. You have to choose the correct discounting and make sure you're competitive. You can check your competitors' pricing with a price comparison tool like Price Watch, for example.

Then you can segment your product feed based on your products' competitiveness. For example, certain products might be very competitive while others might be more expensive than the competition.

Related read: Increasing profitability through segmenting products based on price competitiveness.

This obviously influences your Google Shopping performance as users tend to prefer cheaper deals, of course. So you might want to use custom labels to identify the competitiveness of your products and bid accordingly.

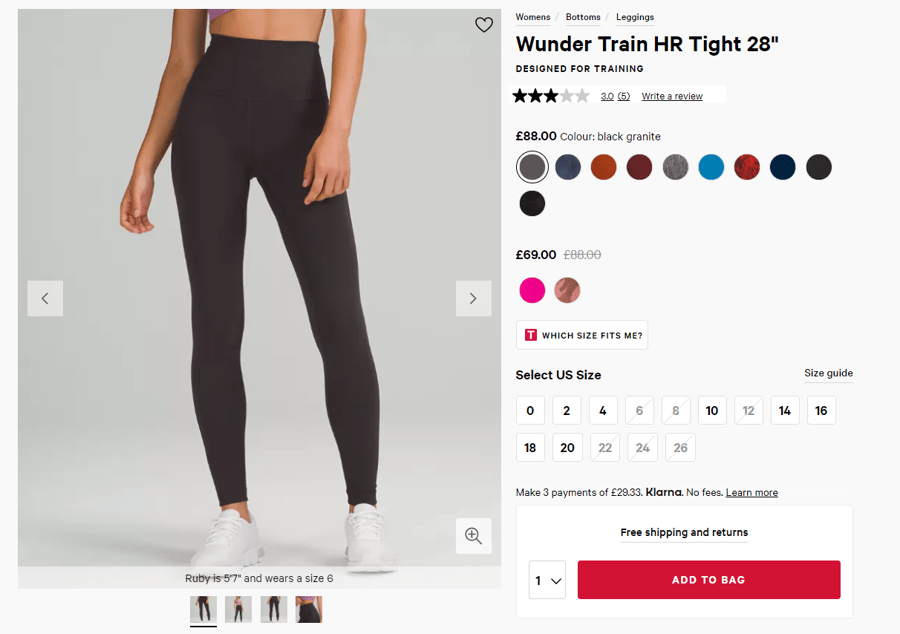

Also, make sure the Price and Sale Price fields are filled and always up-to-date. Start preparing your feed even from now, so you'll be 100% ready when Black Friday comes!

9. Set up product variants correctly

Make sure you use the correct product variants field (item_group_id) in your feed. This way Google knows you have several variants of the same product and won't make them compete against each other.

Including all products, variants will also lead shoppers right to you if they're looking for a specific product that you carry. For example, let's say they're looking for a long, yellow, raincoat. Instead of having to sift through several screens of other colored raincoats, they'll be shown exactly what they want right away.

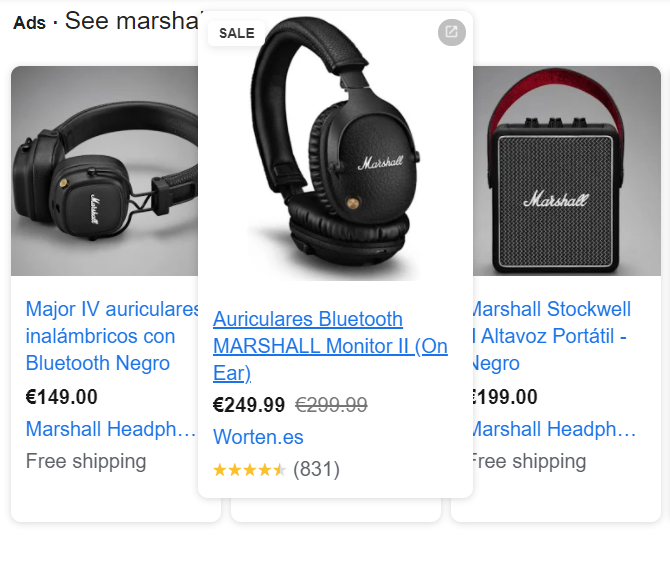

10. Use a promotion feed

A great feature Google introduced a few years ago is Promotion Feeds. Instead of updating product by product in your main feed every time you have a promotion, you can instead upload a promotion feed where you highlight which promotion each product should belong to. When you add a product to your promotions feed, it will also appear in your ads and will help you stand out with any offer that you have.

All of this while not editing the main feed. This is super helpful when you have multiple promotions running at the same time, possibly in different locations and across different product categories. It helps keep things tidy and allows for quicker updates.

All of this while not editing the main feed. This is super helpful when you have multiple promotions running at the same time, possibly in different locations and across different product categories. It helps keep things tidy and allows for quicker updates.

11. Use remarketing audiences

Following the previous point, you could show different promotions to different users. You can do this by having separate campaigns per audience and using promotion feeds. For example, you can:

- Target cart abandoners with a tailored discount.

- Target email subscribers and reward their loyalty with a special promotion. If this is done in conjunction with Black Friday they will particularly love you :)

- Re-engage past purchasers. You might show a tailored discount to users whose last purchase was over 30 days ago. This will make them come back!

- You could even use Google custom segments to target users based on their search behavior. For example, you could create a segment of people searching for "Black Friday deals", or interested in online deals websites.

Let's say you want to target shoppers who have visited a certain website page and left before they added anything to their cart, but found that the conversion rate was lower than targeted. In this case, you could use your discounted items to incentivize shoppers and start boosting sales.

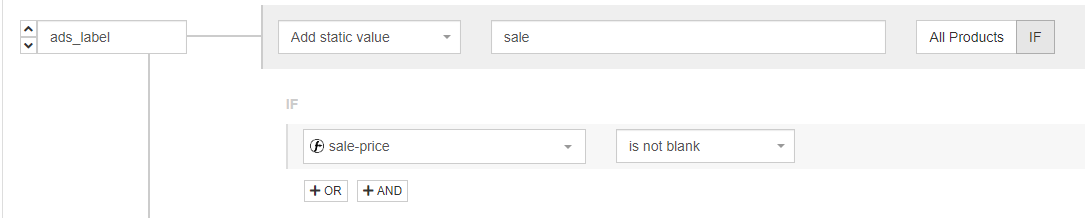

Midsummer Agency did exactly that and created a rule in DataFeedWatch to see the plan through. They created an 'ads_label' and named it 'sales' to segment discounted products.

It's important to note that the 'ads_label' isn't the same as a custom label and can only be used in display campaigns.

Then they created a test remarketing campaign which was an exact copy of the original one. It only showed the products that were on sale and only showed them to shoppers who had had an interest in them in the last 30 days.

The results of this tactic were an 18% increase in conversion rate, a 20% improvement in bounce rate, and a 20% increase in the click-through rate.

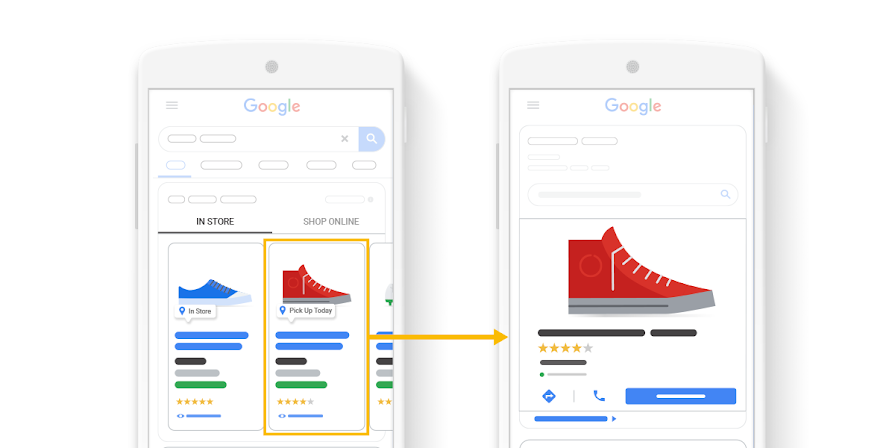

12. Use Google Local Inventory Ads

If you also sell offline you definitely want to look at Local Inventory Ads. We talked about the Local Inventory Ads Feed in our article 6 Google Shopping Feed Types and How to Use Them. Check it out! Local Inventory Ads bridge the gap between the online and offline experience. Users can search for your products and see in which location you sell them.

They can then see the pricing and availability and eventually visit your store and complete the purchase. This will be invaluable this coming holiday season. In fact, we still don't know whether consumers will keep favoring online shopping vs in-store, or even if stores will be at full capacity. Therefore, we need to be ready for any possible scenario.

Local Inventory Ads make sure we are. Also, thanks to this ad format you can highlight potential click-and-collect programs, which we believe will be very popular this year. Users might still prefer to buy online, but also have the certainty of collecting their purchases in person, hence avoiding potential shipping delays and disruptions.

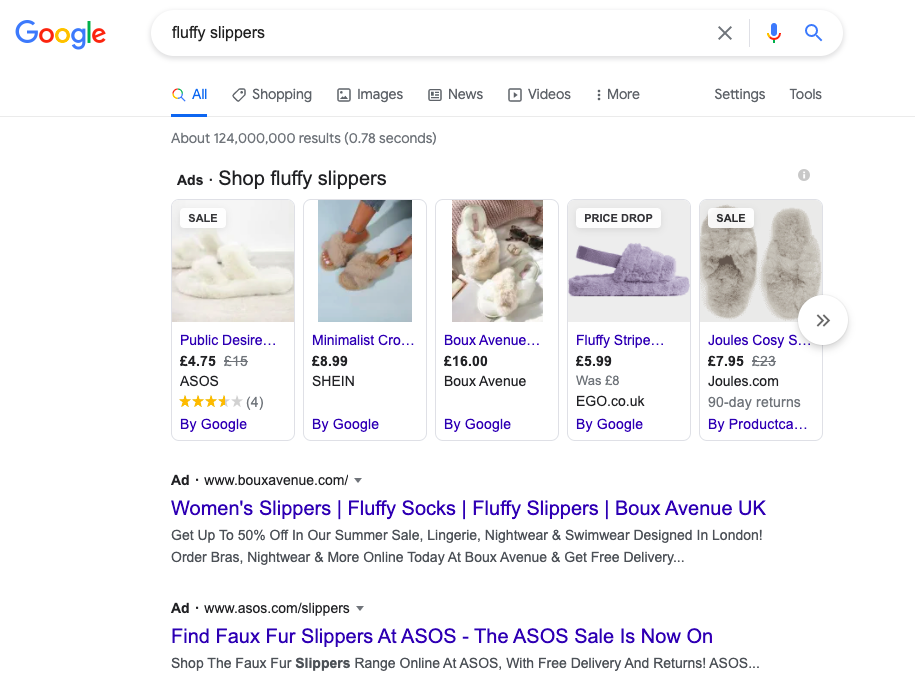

13. Combine the power of Google Shopping with Search Ads

This is one of our favorite tips. Although Google Shopping is the go-to destination for retailers and feed-based campaigns, it is definitely not the only solution you can avail of. Actually, it shouldn't! The Google search result page is busy and you want to be as visible as possible.

For this reason, you should use feeds to also advertise regular search ads. This will double your visibility and chances to get clicked. It's very time-consuming to create a text ad for each product you sell, so our Feed-Driven Text Ads solution will help you do just that - automatically!

Creating a strategic plan for Black Friday and holiday 2023 sales

Now it's time to act and plan your strategy.

Look at Q4 2022 and try to answer the following questions:

- Were there any peaks of traffic before Black Friday? if so, when were they? What happened after Black Friday?

- When did the holiday season ramp-up start?

- Were there peaks of revenue? did they coincide with the peaks in traffic?

But this is still not enough:

- Who were your competitors? Are there any new ones this year? Are there any who don't compete anymore?

- Check your search terms report and see when searches for Black Friday started. What type of search queries did your ads trigger? Generic or product-specific ones? Is there anything you can do better to make your ads even more relevant to those queries?

Take action for Q4 2023:

Based on all the previous information, strategize on when to start, possibly pause and end your campaigns. This year you might want to start as soon as possible. In fact, shipping disruptions and delays are bringing consumers to plan their holiday shopping earlier than ever before. You definitely want to be there right in time for when they'll be looking for you!

Following on what just mentioned, this year there's a new important topic: shipping. Consumers are now aware of the issues retailers are facing with their supply chains. Therefore, they are more sensitive than ever to shipping times, policies, and stock levels. Make sure you do the following to prevent losing customers:

- Be realistic regarding shipping times and communicate them very clearly on your website. Be as transparent as possible.

- Make sure your feeds are always up-to-date so users can see when products are in stock.

- If you have a click-and-collect service, communicate it very prominently in all your advertising channels. It could be a deal-breaker this year.

Go above and beyond

Google Shopping and Ads products in general keep updating all the time. Every year there are new tools marketers can use to advertise their business and defeat competition. Staying up to date with the latest news is not easy and time-consuming.

But it's even harder to eventually implement the new features as you might find resistance from your boss, other stakeholders or even clients if you are an agency.

We at DataFeedWatch are advocates of always following the best practices and upgrading your setup whenever possible. This is year is going to be more relevant than ever. We want to flag a couple of features in Google Shopping that we think you should look at:

- Smart Shopping Campaigns: They have been around for several years now, but they keep getting better year after year. With a single campaign setup, you can advertise seamlessly on all Google Networks, including Shopping, Display, YouTube and Gmail. Make sure you also implement product custom parameters on your website to pump up your campaigns and maximize performance.

- Add a product feed to your Video action campaigns You can add a product feed to your YouTube Ads campaigns. Products are shown in a Shopping-like format under the videos. This is a great addition to your marketing strategy in 2023!

- Take advantage of new Google AI features avaialable in the Merchant Center, for example Google Product Studio.

Conclusion

To recap, these are our main suggestions for the upcoming holiday season:

- Follow all the best practices and e-commerce trends in order to be ready for any potential scenario.

- Make sure your feeds and campaigns are at their best. You can use DataFeedWatch to audit your current status and automate improvements. You don't want to miss out!

- Have clear and transparent communication with your customers, especially around stock and shipping.